As filed with the Securities and Exchange Commission on December 9, 2021

Registration No.

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-1

Registration statement under the Securities Act of 1933

Gaucho Group Holdings, Inc.

| Delaware | 6552 | 52-2158952 | ||

(State or other jurisdiction of incorporation or organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification No.) |

112 NE 41st Street, Suite 106, Miami, Florida 33137

(Address, including zip code, and telephone number, including area code,

of registrant’s principal executive offices)

Scott L. Mathis

President & Chief Executive Officer

Gaucho Group Holdings, Inc.

112 NE 41st Street, Suite 106

Miami, Florida 33137

T. 212-739-7700

(Name, address, including zip code, and telephone number, including area code, of agent service)

Copies to:

Victoria B. Bantz, Esq.

Burns, Figa & Will, P.C.

6400 S. Fiddler’s Green Circle, Suite 1000

Greenwood Village, Colorado 80111

T. 303-796-2626

Approximate Date of Commencement of Proposed Sale to the Public: As soon as possible after this Registration Statement becomes effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, as amended (the “Securities Act”), check the following box. ☒

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ☐ | Accelerated filer ☐ | |

| Non-accelerated filer ☒ | Smaller reporting company ☒ | |

| Emerging growth company ☒ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

CALCULATION OF REGISTRATION FEE

| Title of Each Class of Securities to be Registered | Amount to be Registered(1) | Proposed Maximum Offering Price Per Security(2) | Proposed Maximum Aggregate Offering Price(2) | Amount of Registration Fee | ||||||||||||

| Shares of common stock, par value $0.01 per share, offered by selling stockholders | 12,164,213 | (3) | $ | 2.68 | $ | 32,600,090.84 | $ | 3,022.03 |

(4) | |||||||

| (1) | Pursuant to Rule 416 under the Securities Act of 1933, as amended (the “Securities Act”), the shares of common stock being registered hereunder include such indeterminate number of shares as may be issuable with respect to the shares being registered hereunder as a result of stock splits, stock dividends or similar transactions. | |

| (2) | Estimated solely for the purpose of calculating the amount of registration fee pursuant to Rule 457(c) under the Securities Act. The proposed maximum offering price per share and proposed maximum aggregate offering price are based upon the closing price of the shares of common stock as of December 8, 2021 as quoted on the Nasdaq Capital Market of $2.68. | |

| (3) | Represents a good faith estimate of the shares of common stock underlying a series of senior convertible notes issued by the registrant in a private placement, with such amount equal to the maximum number of shares issuable upon conversion of such notes, including 7% interest accrued through the term of the notes, assuming for purposes hereof that (x) such note is convertible at $0.57 per share, the conversion floor price, and (y) without taking into account the limitations on the conversion of such note (as provided for therein). | |

| (4) | The filing fee of $3,022.03 is being paid concurrently with the filing of this registration statement on Form S-1. |

We hereby amend this registration statement on such date or dates as may be necessary to delay our effective date until we will file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended or until this Registration Statement will become effective on such date as the Securities and Exchange Commission, in accordance with Section 8(a) may determine.

The information in this prospectus is not complete and may be changed. The selling stockholder may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and the selling stockholder is not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED DECEMBER 9, 2021

PRELIMINARY PROSPECTUS

Gaucho Group Holdings, Inc.

12,164,213 Shares

This prospectus relates to the resale from time to time of up to 12,164,213 shares of our common stock, par value $0.01 per share by the selling stockholders set forth under the caption “Selling Stockholders” beginning on page 11 of this prospectus (each individually as a “selling stockholder”).

The shares of common stock registered for resale under this prospectus underlie a series of senior secured convertible promissory notes (the “Notes”) issued to the selling stockholders in a private placement on November 9, 2021. The number of shares registered under this prospectus represents a good faith estimate of the maximum number of shares of common stock issued or issuable pursuant to the Notes, including payment of interest on the notes through November 9, 2022 determined as if the outstanding Notes (including interest on the Notes through November 9, 2022) were converted in full (without regard to any limitations on conversion contained therein solely for the purpose of such calculation) at the floor price of $0.57 (an alternative conversion price under the Notes). The 12,164,213 shares being registered includes 6,082,106, 3,649,264, and 2,432,843 shares, respectively, that may be issued pursuant to the conversion of the principal amount of the Notes, which includes 397,895, 238,736, and 159,158 shares that may be issued pursuant to the conversion of accrued interest over the term of the Notes.

Gaucho Group Holdings, Inc. (the “Company”, “we”, “us”, or “our”) will not receive proceeds from the sale of the shares by the selling stockholders. However, we did receive gross proceeds of $6,000,000 from the sale of the Notes to the selling stockholders pursuant to that certain Securities Purchase Agreement dated November 3, 2021 (the “Purchase Agreement”).

We will pay the expenses of registering these shares, but all selling and other expenses incurred by the selling stockholder will be paid by the selling stockholder. See “Plan of Distribution.”

Our common stock is presently listed on the Nasdaq Capital Market (“Nasdaq”) under the symbol “VINO.” On December 8, 2021, the last reported closing bid price of our common stock on the Nasdaq was $2.68 per share.

You should read this prospectus, together with additional information described under the headings “Incorporation of Certain Information by Reference” and “Where You Can Find More Information,” carefully before you invest in any of our securities.

Investing in the securities involves a high degree of risk. See “Risk Factors” beginning on page 9 of this prospectus.

Neither the Securities and Exchange Commission (the “SEC”) nor any state securities commission has approved or disapproved of the securities offered hereby or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

The date of this prospectus is December 9, 2021

| ii |

| iii |

INDEX

| iv |

The registration statement on Form S-1, of which this prospectus forms a part and that we have filed with the Securities and Exchange Commission (the “SEC”), includes exhibits that provide more detail of the matters discussed in this prospectus.

Additionally, we incorporate by reference important information into this prospectus. You may obtain the information incorporated by reference without charge by following the instructions under the section of this prospectus entitled “Where You Can Find More Information.” You should read this prospectus and the related exhibits filed with the SEC, together with the additional information described under the headings “Incorporation of Certain Information by Reference” and “Where You Can Find More Information.”

You should rely only on the information contained in this prospectus and in any free writing prospectus prepared by or on behalf of us. We have not, and the selling stockholders have not, authorized anyone to provide you with information different from, or in addition to, that contained in this prospectus or any related free writing prospectus. This prospectus is an offer to sell only the securities offered hereby but only under circumstances and in jurisdictions where it is lawful to do so. The information contained in this prospectus is current only as of its date. Our business, financial condition, results of operations and prospects may have changed since that date.

Neither we nor the selling stockholders are offering to sell or seeking offers to purchase these securities in any jurisdiction where the offer or sale is not permitted. Neither we nor the selling stockholders have done anything that would permit this offering or possession or distribution of this prospectus in any jurisdiction where action for that purpose is required, other than in the United States. Persons outside the jurisdiction of the United States who come into possession of this prospectus and any free writing prospectus related to this offering are required to inform themselves about and to observe any restrictions relating to this offering and the distribution of this prospectus and any such free writing prospectus applicable to that jurisdiction.

Unless the context otherwise requires, the terms “Gaucho Group Holdings,” “GGH,” the “Company,” “we,” “us” and “our” refer to Gaucho Group Holdings, Inc. and our subsidiaries. We have registered our name, logo and the trademarks “ALGODON®,” and “Gaucho – Buenos Aires™” in the United States. Other service marks, trademarks and trade names referred to in this prospectus are the property of their respective owners. Except as set forth above and solely for convenience, the trademarks and trade names in this prospectus are referred to without the ®, © and ™ symbols, but such references should not be construed as any indicator that their respective owners will not assert, to the fullest extent under applicable law, their rights thereto.

This prospectus includes industry and market data and other information, which we have obtained from, or is based upon, market research, independent industry publications or other publicly available information. Although we believe each such source to have been reliable as of its respective date, we have not independently verified the information contained in such sources. Any such data and other information is subject to change based on various factors, including those described below under the heading “Risk Factors” and elsewhere in this prospectus.

| 1 |

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

Certain statements included or incorporated by reference in this prospectus constitute forward-looking statements within the meaning of applicable securities laws. All statements contained in this registration statement that are not clearly historical in nature are forward-looking, and the words “anticipate”, “believe”, “continue”, “expect”, “estimate”, “intend”, “may”, “plan”, “will”, “shall” and other similar expressions are generally intended to identify forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”) and Section 21E of the Securities Exchange Act of 1934 (the “Exchange Act”). All forward-looking statements are based on our beliefs and assumptions based on information available at the time the assumption was made. These forward-looking statements are not based on historical facts but on management’s expectations regarding future growth, results of operations, performance, future capital and other expenditures (including the amount, nature and sources of funding thereof), competitive advantages, business prospects and opportunities. Forward-looking statements involve significant known and unknown risks, uncertainties, assumptions and other factors that may cause our actual results, levels of activity, performance or achievements to differ materially from those implied by forward-looking statements. These factors should be considered carefully and prospective investors should not place undue reliance on the forward-looking statements. Although the forward-looking statements contained in this registration statement or incorporated by reference herein are based upon what management believes to be reasonable assumptions, there is no assurance that actual results will be consistent with these forward-looking statements. These forward-looking statements are made as of the date of this registration statement or as of the date specified in the documents incorporated by reference herein, as the case may be. Important factors that could cause such differences include, but are not limited to:

| ● | the uncertainties associated with the ongoing COVID-19 pandemic, including, but not limited to uncertainties surrounding the duration of the pandemic, government orders and travel restrictions, and the effect on the global economy and consumer spending. | |

| ● | the risks and additional expenses associated with international operations and operations in a country (Argentina) which has had significantly high inflation in the past; | |

| ● | the uncertainties raised by a fluid political situation and fundamental policy changes that could be affected by presidential elections;

| |

| ● | the risks associated with a business that has never been profitable, whose business model has been restructured from time to time, and which continues to have and has significant working capital needs; | |

| ● | the possibility of external economic and political factors preventing or delaying the acquisition, development or expansion of real estate projects, or adversely affecting consumer interest in our real estate offerings; | |

| ● | changes in external market factors, as they relate to our emerging e-commerce business; | |

| ● | changes in the overall performance of the industries in which our various business units operate; | |

| ● | changes in business strategies that could be necessitated by market developments as well as economic and political considerations; | |

| ● | possible inability to execute the Company’s business strategies due to industry changes or general changes in the economy generally; | |

| ● | changes in productivity and reliability of third parties, counterparties, joint venturers, suppliers or contractors; and | |

| ● | the success of competitors and the emergence of new competitors. |

Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, levels of activity or performance. You should not place undue reliance on forward-looking statements contained in this prospectus.

We undertake no obligation to update any forward-looking statements to reflect events or circumstances after the date on which such statements were made or to reflect the occurrence of unanticipated events, except as may be required by applicable securities laws.

| 2 |

This summary highlights information contained elsewhere in this prospectus or incorporated by reference. It may not contain all of the information that you should consider before investing in our securities. You should read this entire prospectus carefully, including the “Risk Factors”, “Management’s Discussion and Analysis of Financial Condition and Results of Operations” sections, and the financial statements and related notes included herein. This prospectus includes forward-looking statements that involve risks and uncertainties. See “Cautionary Note Regarding Forward-Looking Statements.”

Company Structure and History

Gaucho Group Holdings, Inc. (“GGH” or the “Company”) is a publicly traded holding company that includes a growing collection of e-commerce retail platforms with a concentration on fine wines, olive oil, hospitality, luxury real estate, leather goods, ready-to-wear, fashion accessories, and luxury home items.

For more than ten years, Gaucho Group Holdings, Inc.’s (gauchoholding.com) mission has been to source and develop opportunities in Argentina’s undervalued luxury real estate and consumer marketplace. Our company has positioned itself to take advantage of the continued and fast growth pace of global e-commerce across multiple market sectors, with the goal of becoming a leader in diversified luxury goods and experiences in sought after lifestyle industries and retail landscapes. With a concentration on fine wines (algodonfinewines.com & algodonwines.com.ar), hospitality (algodonhotels.com) and luxury real estate (algodonwineestates.com) associated with our proprietary Algodon brand, as well as the leather goods, ready-to-wear and accessories of the fashion brand Gaucho – Buenos Aires™ (gauchobuenosaires.com), these are the luxury brands in which Argentina finds its contemporary expression.

GGH seeks to grow its direct-to-consumer online products to global markets in the United States, Asia, the United Kingdom, Europe, and Argentina.

GGH’s goal is to become recognized as the LVMH (“Louis Vuitton Moët Hennessy”) of South America’s leading luxury brands. Through its wholly owned subsidiary Algodon Global Properties, LLC, GGH also owns and operates legacy investments in the boutique hotel, hospitality and luxury vineyard property markets. This includes a golf, tennis and wellness resort, as well as an award winning, wine production company concentrating on Malbecs and Malbec blends. Utilizing these wines as its ambassador, GGH seeks to further develop its legacy real estate, which includes developing residential vineyard lots located within its resort.

The Company’s senior management is based in Florida, and its local operations are managed in Buenos Aires and San Rafael, Argentina by professional staff with considerable e-commerce, wine, hotel, hospitality and resort experience.

The Company was incorporated on April 5, 1999 in the State of Delaware in the dot com era, and has pivoted from its origins as one of the earliest online private investment banking firms to its current mission and offerings. Effective March 11, 2019, the Company changed its name from Algodon Group, Inc. to Gaucho Group Holdings, Inc. to reflect its expanded growth strategy, progress, and transition to a diversified luxury goods company.

Our website is http://www.gauchoholdings.com. Information contained on our website does not constitute part of and is not incorporated into this prospectus.

| 3 |

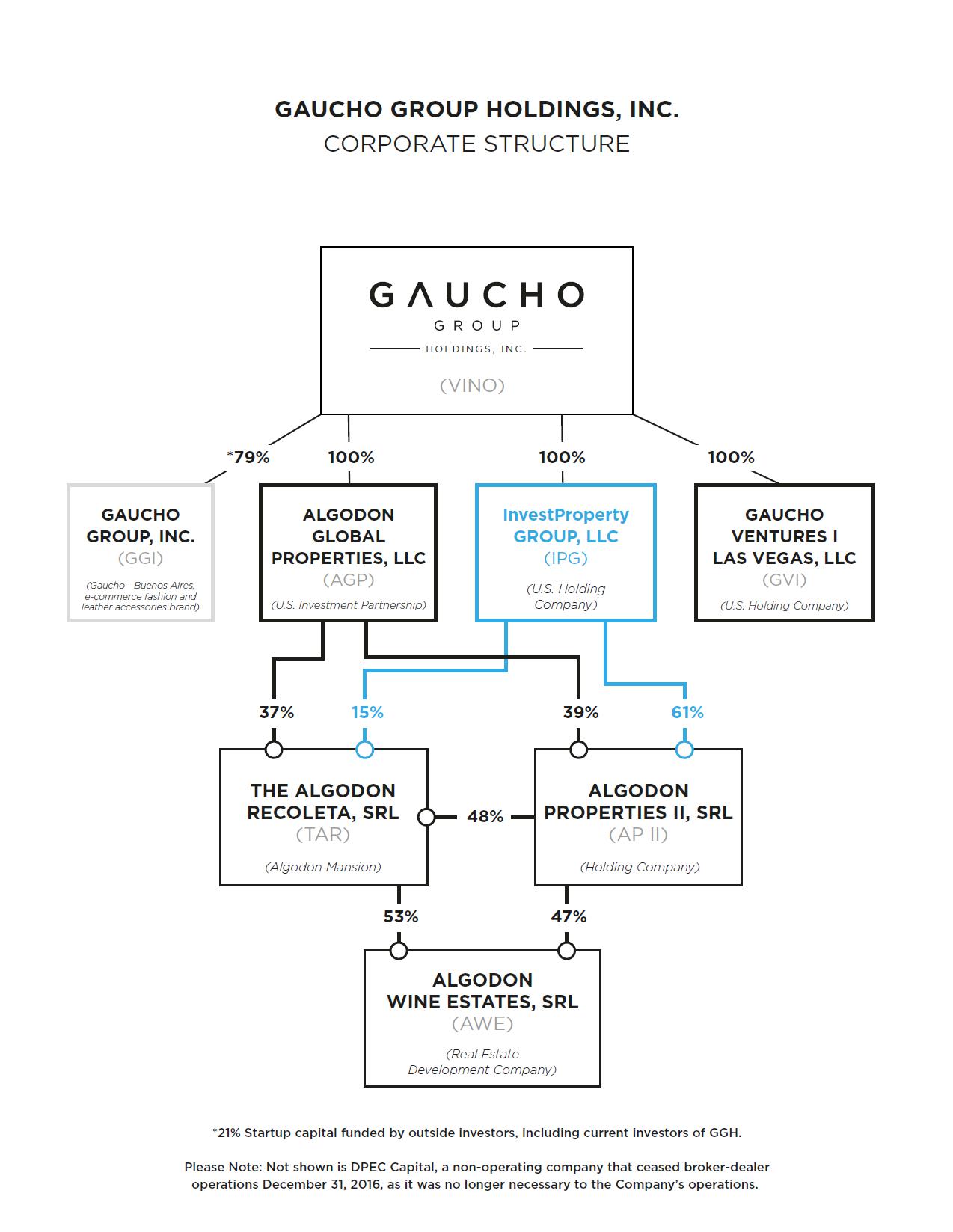

The current corporate organizational structure of GGH and how we have operated substantially for the past year appears below.

| 4 |

The remaining 21% of Gaucho Group, Inc. (“GGI”) is held by certain affiliates and outside investors who provided the startup capital for GGI, a majority of which are stockholders of GGH. At the Company’s 2021 Annual Stockholder Meeting held on August 26, 2021, the stockholders approved the acquisition by the Company of the remaining 21% of shares of GGI in exchange for the issuance of shares of the Company. See “Certain Relationships and Related Transactions” on page 19.

Recent Business Developments

| ● | On June 14, 2021, the Company organized Gaucho Ventures I – Las Vegas, LLC (“GVI”) as a wholly owned subsidiary, pursuant to the Delaware Limited Liability Company Act. | |

| ● | On June 16, 2021, the Company, through GVI, entered into the Amended and Restated Limited Liability Company Agreement of LVH Holdings LLC (“LVH”). As of September 30, 2021, the Company had made a total of $3.5 million in capital contributions and received 198 limited liability company interests which represents 6.25% equity interest. | |

| ● | On July 2, 2021, the Company issued 274,500 shares of common stock upon exercise of warrants to purchase 274,500 shares of common stock with an exercise price of $6.00 per share and received aggregate proceeds of $1,647,000. | |

| ● | On July 6, 2021, the Company issued 8,254 shares of common stock at $4.79 per share with a fair value of $39,537 in settlement of its matching obligations for the year ended December 31, 2020 under the Company’s 401(k) profit sharing plan. | |

| ● | On July 21, 2021, the Company issued 30,000 shares of common stock at $3.53 per share with a fair value of $105,900 pursuant to a service agreement with TraDigital Marketing Group. | |

| ● | On August 26, 2021 at the Annual General Meeting of the Stockholders of the Company, the stockholders approved: (i) an amendment to the 2018 Equity Incentive Plan thereby increasing the number of shares available for awards under the plan to 15% of our common stock outstanding on a fully diluted basis as of the date of stockholder approval; (ii) the purchase of Argentina real estate from Hollywood Burger Holdings, Inc.; and (iii) the purchase of shares of the remaining 21% of common stock of Gaucho Group, Inc. | |

| ● | On October 26, 2021, the Company’s compensation committee approved an extension to our President and CEO’s employment agreement to expire on December 31, 2021. Please see “Executive Compensation” for additional information. | |

| ● | Effective November 1, 2021, Argentina’s borders are open to all travelers who meet certain COVID-19 vaccine requirements. | |

| ● | On November 3, 2021, the Company entered into a Securities Purchase Agreement (the “Purchase Agreement”) with certain institutional investors, pursuant to which on November 9, 2021, the Company sold to the investors a series of senior secured convertible notes of the Company, in the aggregate original principal amount of $6,480,000 (the “Notes”), which Notes shall be convertible into shares of common stock of the Company at a conversion price of $3.50 (subject to adjustment). | |

| ● | On November 10, 2021, the Company made an additional capital contribution to LVH in the amount of $3.5 million and received an additional 198 Units. | |

| ● | On November 11, 2021, in connection with the Purchase Agreement, the Company issued 596,165 shares of common stock to the holders of the Notes. | |

| ● | On November 16, 2021, the Company, through GVI, executed a First Amendment to the LVH LLC Agreement to modify the number, amount, and timing of the Company’s additional capital contributions to LVH. As of November 23, 2021, the Company, through GVI, has made a total of $6.0 million in capital contributions. | |

| ● | On November 24, 2021, the Company filed a registration statement on Form S-1 to register up to 4,500,000 shares of our common stock for resale by Tumim Stone Capital LLC |

For a more thorough discussion of the Company’s business, see “Business” on page 15.

| 5 |

Implications of Being an Emerging Growth Company

We qualify as an “emerging growth company” as defined in the JOBS Act. For so long as we remain an emerging growth company, we are permitted and currently intend to rely on the following provisions of the JOBS Act that contain exceptions from disclosure and other requirements that otherwise are applicable to companies that conduct initial public offerings and file periodic reports with the SEC. These provisions include, but are not limited to:

| ● | being permitted to present only two years of audited financial statements in this prospectus and only two years of related “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in our periodic reports and registration statements, including this prospectus; | |

| ● | not being required to comply with the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act (“SOX”); | |

| ● | reduced disclosure obligations regarding executive compensation in our periodic reports, proxy statements and registration statements, including in this prospectus; and | |

| ● | exemptions from the requirements of holding a nonbinding advisory vote on executive compensation and stockholder approval of any golden parachute payments not previously approved. |

We will remain an emerging growth company until:

| ● | the first to occur of the last day of the fiscal year (i) that follows February 19, 2026, (ii) in which we have total annual gross revenue of at least $1.07 billion or (iii) in which we are deemed to be a “large accelerated filer,” as defined in the Exchange Act, which means the market value of our common stock that is held by non-affiliates exceeds $700 million as of the end of that year’s second fiscal quarter; or | |

| ● | if it occurs before any of the foregoing dates, the date on which we have issued more than $1 billion in non-convertible debt over a three-year period. |

We have elected to take advantage of certain of the reduced disclosure obligations in this prospectus and may elect to take advantage of other reduced reporting requirements in our future filings with the SEC. As a result, the information that we provide to our stockholders may be different than what you might receive from other public reporting companies in which you hold equity interests.

We have elected to avail ourselves of the provision of the JOBS Act that permits emerging growth companies to take advantage of an extended transition period to comply with new or revised accounting standards until those standards apply to private companies. As a result, we will not be subject to new or revised accounting standards at the same time as other public companies that are not emerging growth companies.

For additional information, see the section titled “Risk Factors — Risks of being an Emerging Growth Company — We are an “emerging growth company” and the reduced disclosure requirements applicable to emerging growth companies may make our common stock less attractive to investors.

| Issuer | Gaucho Group Holdings, Inc. | |

Common stock offered by the selling stockholder |

Up to 12,164,213 shares of our common stock, consisting of up to 12,164,213 shares of common stock that we may issue to the selling stockholders, from time to time, upon conversion of the Notes, as described further below. | |

Common stock outstanding prior to this offering |

9,879,081 shares (as of December 8, 2021) | |

Common stock outstanding immediately after this offering |

22,043,294 shares (as of December 8, 2021) | |

| Nasdaq symbol | Our common stock is currently listed on Nasdaq under the symbol “VINO.” | |

| Use of proceeds | We will not receive proceeds from the sale of the shares of our common stock by the selling stockholders through this prospectus. | |

| Risk factors | Investing in our securities involves a high degree of risk. As an investor you should be prepared to lose your entire investment See “Risk Factors” beginning on page 9. |

| 6 |

The above discussion excludes:

| ● | 587,699 shares of common stock underlying options issued as of September 30, 2021 with a weighted average exercise price of $9.67 per share; |

| ● | 2,026,478 shares of common stock underlying warrants issued as of September 30, 2021, with a weighted average exercise price of $5.94; and |

| ● | 1,851,429 shares of common stock underlying secured convertible promissory notes issued as of November 9, 2021. |

On November 3, 2021, the Company entered into a Securities Purchase Agreement (the “Purchase Agreement”) with the selling stockholders. On November 9, 2021, pursuant to the terms of the Purchase Agreement, the Company sold to the selling stockholder a series of senior secured convertible notes of the Company, in the aggregate original principal amount of $6,480,000 (the “Notes”), which Notes are convertible into shares of common stock of the Company at a conversion price of $3.50 (subject to adjustment). The Notes are due and payable on November 9, 2022, and bear interest at a rate of 7% per annum, which shall be payable in cash quarterly in arrears on each Amortization Date (as defined in the Notes) or otherwise in accordance with the terms of the Notes. The investors are entitled to convert any portion of the outstanding and unpaid Conversion Amount (as defined in the Notes) at any time or times on or after issuance, but we may not effect the conversion of any portion of the Notes if it would result in any of the selling stockholders beneficially owning more than 4.99% of the common stock (as calculated pursuant to Section 13(d) of the Securities Exchange Act of 1934, as amended, and Rule 13d-3 thereunder).

The Company and the selling stockholders executed the Purchase Agreement in reliance upon the exemption from securities registration afforded by Section 4(a)(2) of the Securities Act of 1933, as amended (the “Securities Act”), and Rule 506(b) of Regulation D as promulgated by the Securities and Exchange Commission under the Securities Act.

Under the applicable rules of The Nasdaq Stock Market LLC (“Nasdaq”), in no event may we issue any shares of common stock upon conversion of the Notes or otherwise pursuant to the terms of the Notes if the issuance of such shares of common stock would exceed 19.99% of the shares of the common stock outstanding immediately prior to the execution of the Purchase Agreement and Notes (the “Exchange Cap”), unless we (i) obtain stockholder approval to issue shares of common stock in excess of the Exchange Cap or (ii) obtain a written opinion from our counsel that such approval is not required. In any event, we may not issue any shares of our common stock under the Purchase Agreement or Notes if such issuance or sale would breach any applicable rules or regulations of the Nasdaq.

The Notes rank senior to all outstanding and future indebtedness of the Company and its subsidiaries, and are secured by all existing and future assets of the Company, as evidenced by the Security and Pledge Agreement entered into between the Company and the selling stockholders on November 9, 2021 (the “Security Agreement”). Additionally, Scott L. Mathis, President and CEO of the Company, pledged certain of his shares of common stock and certain options to purchase common stock of the Company as additional collateral under the Notes, as evidenced by the Stockholder Pledge Agreement between the Company, Mr. Mathis and the selling stockholders, dated on or about November 9, 2021 (the “Pledge Agreement”).

In connection with the foregoing, the Company entered into a Registration Rights Agreement with the selling stockholders on November 9, 2021 (the “Registration Rights Agreement”), pursuant to which the Company agreed to provide certain registration rights with respect to the Registrable Securities (as defined in the Registration Rights Agreement) under the Securities Act of 1933 (the “Securities Act”) and the rules and regulation promulgated thereunder, and applicable state securities laws. The Purchase Agreement and the Registration Rights Agreement contain customary representations, warranties, conditions and indemnification obligations of the parties. The representations, warranties and covenants contained in such agreements were made only for purposes of such agreements and as of specific dates, were solely for the benefit of the parties to such agreements and may be subject to limitations agreed upon by the contracting parties.

| 7 |

EF Hutton, division of Benchmark Investments, Inc., f/k/a Kingswood Capital Markets (“EF Hutton”), acted as the exclusive placement agent in connection with the transactions contemplated by the Purchase Agreement, for which the Company paid to EF Hutton a cash placement fee equal to 6.0% of the amount of capital raised, invested, or committed under the Purchase Agreement and Note.

The issuance of our common stock to the selling stockholders pursuant to the Purchase Agreement will not affect the rights or privileges of our existing stockholders, except that the economic and voting interests of each of our existing stockholders will be diluted. Although the number of shares of our common stock that our existing stockholders own will not decrease, the shares of our common stock owned by our existing stockholders will represent a smaller percentage of our total outstanding shares of our common stock after any such issuance. There are substantial risks to our stockholders as a result of the sale and issuance of common stock to the selling stockholders under the Purchase Agreement. See “Risk Factors.”

SUMMARY CONSOLIDATED FINANCIAL INFORMATION

The following tables present our summary consolidated financial and other data as of and for the periods indicated. The summary consolidated statements of operations data for the fiscal years ended December 31, 2020 and December 31, 2019, and the summary consolidated balance sheet data as of December 31, 2020 and December 31, 2019, are derived from our audited financial statements incorporated by reference. The consolidated statement of operations data for the three months ended September 30, 2021 and 2020 and the summary consolidated balance sheet data as of September 30, 2021, are derived from our unaudited condensed consolidated financial statements incorporated by reference.

The summarized financial information presented below is derived from and should be read in conjunction with our audited consolidated financial statements and our unaudited consolidated financial statements incorporated by reference including the notes to those financial statements, both of which are incorporated by reference in this prospectus along with the section entitled “Management’s Discussion and Analysis of Financial Condition and Results of Operations.” Our historical results are not necessarily indicative of our future results.

| September 30, | December 31, | |||||||||||

| 2021 | 2020 | 2019 | ||||||||||

| Consolidated Balance Sheets Data: | ||||||||||||

| Cash | $ | 2,836,500 | $ | 134,536 | $ | 40,378 | ||||||

| Total current assets | 6,655,914 | 2,523,342 | 2,428,747 | |||||||||

| Total assets | 17,613,893 | 5,970,536 | 5,920,360 | |||||||||

| Total current liabilities | 2,341,579 | 5,096,441 | 5,737,953 | |||||||||

| Total liabilities | 4,031,728 | 5,576,710 | 5,920,934 | |||||||||

| Total stockholders’ equity (deficiency) | 17,613,893 | (8,616,998 | ) | (9,027,398 | ) | |||||||

| For the Three Months Ended | For the Years Ended | |||||||||||||||

| September 30, | December 31, | |||||||||||||||

| 2021 | 2020 | 2020 | 2019 | |||||||||||||

| Statement of Operations: | ||||||||||||||||

| Sales | $ | 2,605,158 | $ | 60,288 | $ | 635,789 | $ | 1,284,437 | ||||||||

| Net income (loss) | 887,233 | (1,007,087 | ) | (5,781,683 | ) | (6,956,815 | ) | |||||||||

| 8 |

An investment in our securities involves certain risks relating to our structure and investment objective. The risks set forth below are the risks we have identified and which we currently deem material or predictable. We also may face additional risks and uncertainties not currently known to us, or which as of the date of this Annual Report we might not consider significant, which may adversely affect our business. In general, you take more risk when you invest in the securities of issuers in emerging markets such as Argentina than when you invest in the securities of issuers in the United States. If any of the following risks occur, our business, financial condition and results of operations could be materially adversely affected. In such case, our net asset value and the price of our common stock could decline, and you may lose all or part of your investment.

In evaluating the Company, its business and any investment in the Company, readers should carefully consider the following factors, together with the additional risk factors incorporated by reference from Item 1A of the Company’s Annual Report on Form 10-K as filed with the SEC on April 12, 2021, from Item 1A of the Company’s Quarterly Report on Form 10-Q as filed with the SEC on May 17, 2021, and from Item 1A of the Company’s Quarterly Report on Form 10-Q as filed with the SEC on August 16, 2021 (see “Incorporation of Certain Information by Reference”):

Risks Related to this Offering

Investors who buy shares at different times will likely pay different prices.

Each of the selling stockholders has the discretion to convert the Notes into shares of common stock. If and when the selling stockholders elect to convert their Notes, such selling stockholders may resell all, some or none of such shares at any time or from time to time in its discretion and at different prices. As a result, investors who purchase shares from the selling stockholders in this offering at different times will likely pay different prices for those shares, and so may experience different levels of dilution and in some cases substantial dilution and different outcomes in their investment results.

Future sales and issuances of our common stock or other securities might result in significant dilution and could cause the price of our common stock to decline.

To raise capital, we may sell common stock, convertible securities or other equity securities in one or more transactions, at prices and in a manner we determine from time to time. We may sell shares or other securities in any other offering at a price per share that is less than the price per share paid by investors in this offering, and investors purchasing shares or other securities in the future could have rights superior to existing stockholders. The price per share at which we sell additional shares of our common stock, or securities convertible or exchangeable into common stock, in future transactions may be higher or lower than the price per share paid by investors in this offering.

We cannot predict what effect, if any, sales of shares of our common stock in the public market or the availability of shares for sale will have on the market price of our common stock. However, future sales of substantial amounts of our common stock in the public market, including shares issued upon exercise of outstanding options, or the perception that such sales may occur, could adversely affect the market price of our common stock.

Management will have broad discretion as to the use of the proceeds from the offering, and uses may not improve our financial condition or market value.

Because we have not designated the amount of net proceeds from the offering to be used for any particular purpose, our management will have broad discretion as to the application of such net proceeds and could use them for purposes other than those contemplated hereby. Our management may use the net proceeds for corporate purposes that may not improve our financial condition or market value.

| 9 |

We face significant business disruption and related risks resulting from the COVID-19 pandemic, which could have a material adverse effect on our business and results of operations.

We temporarily closed our hotel, restaurant, winery operations, and golf and tennis operations. On October 19, 2020, we re-opened our winery and golf and tennis facilities with COVID-19 measures implemented. Most recently, we reopened the Algodon Mansion as of November 11, 2020 with COVID-19 measures implemented. Due to COVID-19 restrictions on workers, construction on homes was temporarily halted from March to September but has resumed. As of November 1, 2021, the Argentina borders are open to tourists, subject to certain COVID-19 vaccine requirements.

The Company reduced expenses by negotiating an early termination of our office lease at 135 Fifth Avenue in New York City, and all employees and contractors are currently working from home. In addition, we are reviewing our labor needs to run the administrative side of the Company in New York.

Throughout the pandemic, we also experienced significant delays in product development, production, and shipping from our overseas manufacturing partners, many of whom have been on complete lockdown for the safety of their workers. Some of our manufacturing partners have even had to close permanently. Because of this, we are in the process of pursuing new vendors.

Due to the events stated above, it was necessary for us to reduce our email marketing efforts to our customer database, as we were not able to fulfill orders. This resulted in a significant reduction in our web traffic and sales.

Although the Company presently has enough cash on hand to sustain its operations on a month to month basis, we are continuing to explore opportunities with third parties and related parties to provide some or all of the capital that we need. However, if we are unable to obtain additional financing on a timely basis, we may have to delay vendor payments and/or initiate cost reductions, which would have a material adverse effect on our business, financial condition and results of operations, and ultimately, we could be forced to discontinue our operations, liquidate assets and/or seek reorganization under the U.S. bankruptcy code.

This prospectus relates to the sale or other disposition of shares of our shares by the selling stockholders listed under “Selling Stockholders” section below, and their transferees. We will not receive any proceeds from any sale of the shares by the selling stockholders.

Determination of offering price

The selling stockholders will offer common stock at the prevailing market prices or privately negotiated price as they may determine from time to time.

The offering price of our common stock to be sold by the selling stockholders does not necessarily bear any relationship to our book value, assets, past operating results, financial condition or any other established criteria of value. The facts considered in determining the offering price were our financial condition and prospects, our limited operating history and the general condition of the securities market.

In addition, there is no assurance that our common stock will trade at market prices in excess of the offering price as prices for common stock in any public market will be determined in the marketplace and may be influenced by many factors, including the depth and liquidity.

| 10 |

The shares of common stock being offered by the selling stockholders are those issuable to the selling stockholders upon conversion of the notes. For additional information regarding the issuance of the notes, see “Private Placement of Notes” above. We are registering the shares of common stock in order to permit the selling stockholders to offer the shares for resale from time to time. Except for the ownership of the notes issued pursuant to the Purchase Agreement, the selling stockholders have not had any material relationship with us within the past three years.

The table below lists the selling stockholders and other information regarding the beneficial ownership (as determined under Section 13(d) of the Securities Exchange Act of 1934, as amended, and the rules and regulations thereunder) of the shares of common stock held by each of the selling stockholders. The second column lists the number of shares of common stock beneficially owned by the selling stockholders, based on their respective ownership of shares of common stock and Notes, as of December 8, 2021, assuming conversion of the Notes held by each such selling stockholder on that date but taking account of any limitations on conversion set forth therein.

The third column lists the shares of common stock being offered by this prospectus by the selling stockholders and does not take in account any limitations on conversion of the Notes set forth therein.

In accordance with the terms of a Registration Rights Agreement with the holders of the Notes, this prospectus generally covers the resale of 100% of the maximum number of shares of common stock issued or issuable pursuant to the Notes, including payment of interest on the notes through November 9, 2022 determined as if the outstanding Notes (including interest on the Notes through November 9, 2022) were converted in full (without regard to any limitations on conversion contained therein solely for the purpose of such calculation) at the floor price of $0.57. Because the conversion price of the notes may be adjusted, the number of shares that will actually be issued may be more or less than the number of shares being offered by this prospectus. The fourth column assumes the sale of all of the shares offered by the selling stockholders pursuant to this prospectus.

Under the terms of the Notes, a selling stockholder may not convert the Notes to the extent (but only to the extent) such selling stockholder or any of its affiliates would beneficially own a number of shares of our common stock which would exceed 4.99% of the outstanding shares of the Company (the “Maximum Percentage”). The number of shares in the second column reflects these limitations. The selling stockholders may sell all, some or none of their shares in this offering. See “Plan of Distribution.”

| Name of Selling Stockholder |

Number of Shares of Common Stock Owned Prior to Offering(1) |

Maximum Number of Shares of Common Stock to be Sold Pursuant to this Prospectus(9) |

Number of Shares of Common Stock Owned After Offering(1) |

|||||||||||||||||

| Number | Percent | Number(5) | Percent | |||||||||||||||||

| 3i, LP(6) | 503,878 | (2) | 4.99 | % | 6,082,106 | 336,878 | 1.51 | % | ||||||||||||

| Nomis Bay, Ltd.(7) | 504,699 | (3) | 4.99 | % | 3,649,264 | 0 | 0 | % | ||||||||||||

| BPY Limited(8) | 509,466 | (4) | 4.99 | % | 2,432,843 | 0 | 0 | % | ||||||||||||

| (1) | Applicable percentage ownership is based on 9,879,081 shares of our common stock outstanding as of December 8, 2021 and based on 22,043,294 shares of our common stock outstanding after the offering. |

| (2) | This column lists the number of shares of common stock beneficially owned by the selling stockholder, as of December 8, 2021, after giving effect to the Maximum Percentage (as defined in the paragraph above). Without regard to the Maximum Percentage, our common stock beneficially owned by 3i, LP would include (i) 35,000 shares of common stock acquired by 3i, LP, the sole member of Tumim Stone Capital, in a transaction unrelated to the transactions contemplated by the Purchase Agreement, none of which shares are being registered for resale under this prospectus; (ii) up to 200,000 shares of common stock underlying warrants held by 3i, LP, currently exercisable, representing the shares underlying such warrants that may be issued to 3i, LP as of the date of this prospectus upon exercise of such warrants (at a price of $6.00 per share), subject to a 4.99% beneficial ownership cap limitation therein, acquired by 3i, LP in a transaction unrelated to the transactions contemplated by the Purchase Agreement, none of which underlying warrant shares are being registered for resale under this prospectus; (iii) up to 990,515 shares of common stock (including 148,000 shares of our common stock that were pre-delivered to 3i, LP on the issuance date of the Notes as of November 9, 2021) underlying the Note held by 3i, LP, representing the shares underlying such secured convertible promissory note that may be issued (or, with respect to the 148,000 shares pre-delivered, has been issued) to 3i, LP as of the date of this prospectus assuming a conversion price of $3.50, all of which shares are being registered for resale under this prospectus and (iv) 101,878 shares of common stock acquired by Tumim Stone Capital, pursuant to the Common Stock Purchase Agreement dated May 6, 2021, none of which shares are being registered for resale under this prospectus and all of which shares were registered for resale under a prior registration statement. |

| 11 |

| (3) | This column lists the number of shares of common stock beneficially owned by the selling stockholder, as of December 8, 2021, after giving effect to the Maximum Percentage. Without regard to the Maximum Percentage, our common stock beneficially owned by Nomis Bay, Ltd. includes 594,309 shares of common stock (including 268,899 shares of our common stock that were pre-delivered to Nomis Bay, Ltd. on the issuance date of the Notes as of November 9, 2021) underlying conversion of the Note held by Nomis Bay, Ltd. representing the shares underlying such secured convertible promissory note that may be issued (or with respect to the 268,899 shares pre-delivered, has been issued) to Nomis Bay, Ltd. as of the date of this prospectus upon conversion of the secured convertible note (at the conversion price of $3.50 per share), acquired by Nomis Bay, LP in a transaction related to the transactions contemplated by the Purchase Agreement, all of which underlying shares are being registered for resale under this prospectus. |

| (4) | This column lists the number of shares of common stock beneficially owned by the selling stockholder, as of December 8, 2021, after giving effect to the Maximum Percentage. Without regard to the Maximum Percentage, our common stock beneficially owned by BPY Limited consists of 396,206 shares of common stock (including 179,266 shares of our common stock that were pre-delivered to BPY Limited on the issuance date of the Notes as of November 9, 2021) underlying conversion of the Note held by BPY Limited representing the shares underlying such secured convertible note that may be issued (or with respect to the 179,266 shares pre-delivered, has been issued) to by BPY Limited as of the date of this prospectus upon conversion of the secured convertible note (at the conversion price of $3.50 per share) acquired by BPY Limited in a transaction related to the transactions contemplated by the Purchase Agreement, all of which underlying shares are being registered for resale under this prospectus. |

| (5) | Assumes the sale of all of the shares offered by the selling stockholders pursuant to this prospectus. |

| (6) | The business address of 3i, LP is 140 Broadway, 38th Floor, New York, NY 10005. 3i, LP’s principal business is that of a private investor. Maier Joshua Tarlow is the manager of 3i Management, LLC, the general partner of 3i, LP, and has sole voting control and investment discretion over securities beneficially owned directly by 3i, LP and indirectly by 3i Management, LLC. We have been advised that none of Mr. Tarlow, 3i Management, LLC, or 3i, LP is a member of the Financial Industry Regulatory Authority, or FINRA, or an independent broker-dealer, or an affiliate or associated person of a FINRA member or independent broker-dealer. Each of Mr. Tarlow, 3i, LP, and 3i Management, LLC, disclaim any beneficial ownership of these shares. |

| (7) | The business address of Nomis Bay, Ltd. is Wessex House, 3rd floor, 45 Reid Street, Hamilton, Bermuda HM 12. Nomis Bay, Ltd.’s principal business is that of a private investor. Murchinson Ltd. (“Murchinson”), as sub-advisor to Nomis Bay Ltd., has voting and investment power with respect to these shares. Marc Bistricer, in his capacity as CEO of Murchinson, may also be deemed to have investment discretion and voting power over the shares held by Nomis Bay Ltd. Each of Mr. Bistricer and Murchinson disclaims any beneficial ownership of these shares. |

| (8) | The business address of BPY Limited is Wessex House, 3rd floor, 45 Reid Street, Hamilton, Bermuda HM 12. BPY Limited’s principal business is that of a private investor. Murchinson Ltd. (“Murchinson”), as sub-advisor to BPY Limited, has voting and investment power with respect to these shares. Marc Bistricer, in his capacity as CEO of Murchinson, may also be deemed to have investment discretion and voting power over the shares held by BPY Limited. Each of Mr. Bistricer and Murchinson disclaims any beneficial ownership of these shares. |

| (9) | For the purposes of the calculations of the common stock to be sold pursuant to the prospectus we are assuming an event of default has occurred and is continuing, and that the Notes are converted in full at a floor price of $0.57 per share without regard to any limitations set forth therein. |

| 12 |

We are registering the shares of common stock issuable upon conversion of the Notes to permit the resale of these shares of common stock by the holders of the Notes from time to time after the date of this prospectus. We will not receive any of the proceeds from the sale by the selling stockholders of the shares of common stock. We will bear all fees and expenses incident to our obligation to register the shares of common stock.

The selling stockholders may sell all or a portion of the shares of common stock held by them and offered hereby from time to time directly or through one or more underwriters, broker-dealers or agents. If the shares of common stock are sold through underwriters or broker-dealers, the selling stockholders will be responsible for underwriting discounts or commissions or agent’s commissions. The shares of common stock may be sold in one or more transactions at fixed prices, at prevailing market prices at the time of the sale, at varying prices determined at the time of sale or at negotiated prices. These sales may be effected in transactions, which may involve crosses or block transactions, pursuant to one or more of the following methods:

| ● | on any national securities exchange or quotation service on which the securities may be listed or quoted at the time of sale; | |

| ● | in the over-the-counter market; | |

| ● | in transactions otherwise than on these exchanges or systems or in the over-the-counter market; | |

| ● | through the writing or settlement of options, whether such options are listed on an options exchange or otherwise; | |

| ● | ordinary brokerage transactions and transactions in which the broker-dealer solicits purchasers; | |

| ● | block trades in which the broker-dealer will attempt to sell the shares as agent but may position and resell a portion of the block as principal to facilitate the transaction; | |

| ● | purchases by a broker-dealer as principal and resale by the broker-dealer for its account; | |

| ● | an exchange distribution in accordance with the rules of the applicable exchange; | |

| ● | privately negotiated transactions; | |

| ● | short sales made after the date the Registration Statement is declared effective by the SEC; | |

| ● | broker-dealers may agree with a selling security holder to sell a specified number of such shares at a stipulated price per share; | |

| ● | a combination of any such methods of sale; and | |

| ● | any other method permitted pursuant to applicable law. |

The selling stockholders may also sell shares of common stock under Rule 144 promulgated under the Securities Act of 1933, as amended, if available, rather than under this prospectus. In addition, the selling stockholders may transfer the shares of common stock by other means not described in this prospectus. If the selling stockholders effect such transactions by selling shares of common stock to or through underwriters, broker-dealers or agents, such underwriters, broker-dealers or agents may receive commissions in the form of discounts, concessions or commissions from the selling stockholders or commissions from purchasers of the shares of common stock for whom they may act as agent or to whom they may sell as principal (which discounts, concessions or commissions as to particular underwriters, broker-dealers or agents may be in excess of those customary in the types of transactions involved). In connection with sales of the shares of common stock or otherwise, the selling stockholders may enter into hedging transactions with broker-dealers, which may in turn engage in short sales of the shares of common stock in the course of hedging in positions they assume. The selling stockholders may also sell shares of common stock short and deliver shares of common stock covered by this prospectus to close out short positions and to return borrowed shares in connection with such short sales. The selling stockholders may also loan or pledge shares of common stock to broker-dealers that in turn may sell such shares.

The selling stockholders may pledge or grant a security interest in some or all of the Notes or shares of common stock owned by them and, if they default in the performance of their secured obligations, the pledgees or secured parties may offer and sell the shares of common stock from time to time pursuant to this prospectus or any amendment to this prospectus under Rule 424(b)(3) or other applicable provision of the Securities Act amending, if necessary, the list of selling stockholders to include the pledgee, transferee or other successors in interest as selling stockholders under this prospectus. The selling stockholders also may transfer and donate the shares of common stock in other circumstances in which case the transferees, donees, pledgees or other successors in interest will be the selling beneficial owners for purposes of this prospectus.

| 13 |

To the extent required by the Securities Act and the rules and regulations thereunder, the selling stockholders and any broker-dealer participating in the distribution of the shares of common stock may be deemed to be “underwriters” within the meaning of the Securities Act, and any commission paid, or any discounts or concessions allowed to, any such broker-dealer may be deemed to be underwriting commissions or discounts under the Securities Act. At the time a particular offering of the shares of common stock is made, a prospectus supplement, if required, will be distributed, which will set forth the aggregate amount of shares of common stock being offered and the terms of the offering, including the name or names of any broker-dealers or agents, any discounts, commissions and other terms constituting compensation from the selling stockholders and any discounts, commissions or concessions allowed or re-allowed or paid to broker-dealers.

Under the securities laws of some states, the shares of common stock may be sold in such states only through registered or licensed brokers or dealers. In addition, in some states the shares of common stock may not be sold unless such shares have been registered or qualified for sale in such state or an exemption from registration or qualification is available and is complied with.

There can be no assurance that any selling stockholder will sell any or all of the shares of common stock registered pursuant to the registration statement, of which this prospectus forms a part.

The selling stockholders and any other person participating in such distribution will be subject to applicable provisions of the Securities Exchange Act of 1934, as amended, and the rules and regulations thereunder, including, without limitation, to the extent applicable, Regulation M of the Exchange Act, which may limit the timing of purchases and sales of any of the shares of common stock by the selling stockholders and any other participating person. To the extent applicable, Regulation M may also restrict the ability of any person engaged in the distribution of the shares of common stock to engage in market-making activities with respect to the shares of Common stock. All of the foregoing may affect the marketability of the shares of Common stock and the ability of any person or entity to engage in market-making activities with respect to the shares of Common stock.

We will pay all expenses of the registration of the shares of Common stock pursuant to the Registration Rights Agreement, estimated to be $50,000 in total, including, without limitation, Securities and Exchange Commission filing fees and expenses of compliance with state securities or “blue sky” laws; provided, however, a selling stockholder will pay all underwriting discounts and selling commissions, if any. We will indemnify the selling stockholders against liabilities, including some liabilities under the Securities Act in accordance with the Registration Rights Agreements or the selling stockholders will be entitled to contribution. We may be indemnified by the selling stockholders against civil liabilities, including liabilities under the Securities Act that may arise from any written information furnished to us by the selling stockholder specifically for use in this prospectus, in accordance with the related registration rights agreements or we may be entitled to contribution.

Once sold under the registration statement, of which this prospectus forms a part, the shares of common stock will be freely tradable in the hands of persons other than our affiliates.

This Offering will terminate on the date that all shares of our common stock offered by this prospectus have been sold by the selling stockholder.

Our common stock is currently listed on Nasdaq under the symbol “VINO”.

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

Our discussion and analysis of financial condition and results of operations is incorporated by reference from Part II, Item 7 of the Company’s Annual Report on Form 10-K as filed with the SEC on April 12, 2021, from Part I, Item 2 of the Company’s Quarterly Report on Form 10-Q as filed with the SEC on May 17, 2021, from Part I, Item 2 of the Company’s Quarterly Report on Form 10-Q as filed with the SEC on August 16, 2021, and from Part I, Item 2 of the Company’s Quarterly Report on Form 10-Q as filed with the SEC on November 15, 2021 (see “Incorporation of Certain Information by Reference”).

| 14 |

The description of our business is incorporated by reference from Part I, Item 1 of the Company’s Annual Report on Form 10-K as filed with the SEC on April 12, 2021 (see “Incorporation of Certain Information by Reference”).

DESCRIPTION OF OUR CAPITAL STOCK

The following description summarizes important terms of our capital stock and our other securities. For a complete description, you should refer to our Certificate of Incorporation and bylaws, forms of which are incorporated by reference to the exhibits to the registration statement of which this prospectus is a part, as well as the relevant portions of the Delaware General Corporation Law (“DGCL”). Please also see “Effect of Certain Provisions of our Bylaws” below.

Capital Stock

The Company has two classes of stock: common and preferred. The Company’s Certificate of Incorporation authorizes the issuance of up to 150,000,000 shares of common stock, par value $0.01 per share, and 11,000,000 shares of preferred stock, par value $0.01 per share.

Common Stock

As of December 8, 2021 there were 9,882,450 shares of common stock issued and 9,879,081 shares of common stock outstanding. 3,369 shares of our common stock that are held by the Company in treasury are the result of the redemption of WOW Group membership interests and indirectly, GGH’s shares. Each share of common stock entitles the holder thereof to one vote, either in person or by proxy, at a meeting of stockholders. The holders are not entitled to vote their shares cumulatively. Accordingly, the holders of more than 50% of the issued and outstanding shares of common stock can elect all of the directors of the Company.

Each share of common stock has equal and identical rights to every other share for purposes of dividends, liquidation preferences, voting rights and any other attributes of the Company’s common stock. No voting trusts or any other arrangement for preferential voting exist among any of the stockholders, and there are no restrictions in the articles of incorporation, or bylaws precluding issuance of further common stock or requiring any liquidation preferences, voting rights or dividend priorities with respect to this class of stock.

All shares of common stock are entitled to participate ratably in dividends when and as declared by the Company’s board of directors out of the funds legally available. Any such dividends may be paid in cash, property or additional shares of common stock. The Company has not paid any dividends on its shares of common stock since its inception and presently anticipates that no dividends on such shares will be declared in the foreseeable future. Any future dividends will be subject to the discretion of the Company’s board of directors and will depend upon, among other things, future earnings, the operating and financial condition of the Company, its capital requirements, general business conditions and other pertinent facts. Therefore, there can be no assurance that any dividends on the common stock will be paid in the future.

Holders of common stock have no preemptive rights or other subscription rights, conversion rights, redemption or sinking fund provisions. In the event of the dissolution, whether voluntary or involuntary of the Company, each share of common stock is entitled to share ratably in any assets available for distribution to holders of the equity securities of the Company after satisfaction of all liabilities.

Preferred Stock

As of December 8, 2021, the Company has authorized 11,000,000 shares of preferred stock, with 10,097,330 shares designated as Series A Convertible Preferred Stock, par value $0.01 per share (“Series A Preferred”), and 902,670 shares designated as Series B Preferred Stock. The Board of Directors has the ability to issue blank check preferred stock under the Certificate of Incorporation.

| 15 |

As of December 8, 2021, there were no shares issued and outstanding of Series A Preferred and no shares issued and outstanding shares of Series B Preferred Stock.

Warrants

On February 19, 2021, as of part of the public offering and uplist to Nasdaq, the Company issued 1,533,333 common stock purchase warrants as part of the units. Each warrant has an exercise price equal to $6.00. The warrants are immediately exercisable and will expire on the eighteen-month anniversary of the original issuance date. The warrants may be exercised only for a whole number of shares of our common stock, and no fractional shares will be issued upon exercise of the warrants.

Outstanding Stock Options and Warrants

As of September 30, 2021, there were options to acquire a total of 587,699 shares of common stock granted pursuant to our 2016 and 2018 equity incentive plans at a weighted-average exercise price of $9.67, of which 353,680 shares of our common stock are issuable upon exercise of outstanding stock options at a weighted-average exercise price of $11.03 per share, and there were warrants to acquire a total of 2,026,478 shares of our common stock, all of which are issuable upon exercise, at a weighted-average exercise price of $5.94.

Securities Purchase Agreement with Tumim Stone Capital LLC

On May 6, 2021, the Company entered into a Common Stock Purchase Agreement (the “SPA”) and a Registration Rights Agreement (the “Registration Rights Agreement”) with Tumim Stone Capital LLC (“Tumim Stone Capital”). We have already received proceeds of approximately $5,135,210 from the sale of our common stock to Tumim Stone Capital pursuant to the SPA. The SPA provides us the right to sell to Tumim Stone Capital shares of the Company’s common stock for gross proceeds of up to $50,000,000, subject to certain limitations and conditions set forth therein.

In connection with the SPA, we also executed that certain Registration Rights Agreement dated May 6, 2021 (the “Registration Rights Agreement”), pursuant to which we agreed to register the resale by Tumim Stone Capital of the shares of common stock issued to Tumim Stone Capital under the SPA. In accordance with the Registration Rights Agreement, we previously filed a registration statement with the Securities and Exchange Commission (the “SEC”) effective May 25, 2021 (the “Prior Registration Statement”) pursuant to which we registered 1,494,404 shares of common stock. This number represented 19.99% of the shares of common stock outstanding immediately prior to the execution of the SPA (the “Exchange Cap”), which pursuant to the rules of the Nasdaq Capital Market (“Nasdaq”), we are limited in issuing shares in excess of the Exchange Cap without stockholder approval.

As of November 23, 2021, the Company has sold to Tumim Stone Capital a total of 1,374,067 shares of common stock under the SPA and issued 120,337 Commitment Shares, all of which were registered for resale pursuant to the Prior Registration Statement. As of November 23, 2021, a total of 101,878 shares issued under the SPA may be resold by Tumim Stone Capital under the Prior Registration Statement. Pursuant to the SPA, we may continue to receive gross proceeds of up to an additional $44,864,790 from the sale of our common stock to Tumim Stone Capital.

Subsequent to the effectiveness of the Prior Registration Statement, and pursuant to the applicable Nasdaq rules, the Company’s stockholders on August 26, 2021 approved the issuance of an additional 10,000,000 shares of common stock to Tumim Stone Capital pursuant to the SPA, thereby allowing us to issue up to 10,000,000 shares in excess of the Exchange Cap.

On November 24, 2021, the Company filed a second registration statement on Form S-1, which registers 4,500,000 shares of common stock for resale, allowing us to raise approximately $13,500,000, based upon the Nasdaq closing price on November 23, 2021 of $3.00, once the registration statement is declared effective.

EF Hutton, division of Benchmark Investments, Inc. acted as the exclusive placement agent in connection with the transactions contemplated by the SPA, for which the Company will pay to EF Hutton a cash placement fee equal to 8.0% of the amount of the Total Commitment actually paid by Tumim Stone Capital to the Company pursuant to the SPA.

Effect of Certain Provisions of our Bylaws

Our Bylaws contain provisions that could have the effect of delaying, deferring, or discouraging another party from acquiring control of us. These provisions and certain provisions of Delaware law, which are summarized below, could discourage takeovers, coercive or otherwise.

| 16 |

Our Bylaws provide for our Board of Directors to be divided into three classes serving staggered terms. Approximately one-third of the Board of Directors will be elected each year. This method of electing directors makes changes in the composition of the Board of Directors more difficult, and thus a potential change in control of a corporation a lengthier and more difficult process. A classified board of directors is designed to assure continuity and stability in a board of directors’ leadership and policies by ensuring that at any given time a majority of the directors will have prior experience with our Company and be familiar with our business and operations.

The classified board structure may increase the amount of time required for a takeover bidder to obtain control of the Company without the cooperation of our Board of Directors, even if the takeover bidder were to acquire a majority of the voting power of our outstanding Common stock. Without the ability to obtain immediate control of our Board of Directors, a takeover bidder will not be able to take action to remove other impediments to its acquisition of our Company. Thus, a classified Board of Directors could discourage certain takeover attempts, perhaps including some takeovers that stockholders may feel would be in their best interests. Further, a classified Board of Directors will make it more difficult for stockholders to change the majority composition of our Board of Directors, even if our stockholders believe such a change would be beneficial. Because a classified Board of Directors will make the removal or replacement of directors more difficult, it will increase the directors’ security in their positions, and could be viewed as tending to perpetuate incumbent management.

Since the creation of a classified Board of Directors will increase the amount of time required for a hostile bidder to acquire control of our Company, the existence of a classified board of directors could tend to discourage certain tender offers which stockholders might feel would be in their best interest. However, our Board of Directors believes that forcing potential bidders to negotiate with our Board of Directors for a change of control transaction will allow our Board of Directors to better maximize stockholder value in any change of control transaction.

Our bylaws also provide that, unless we consent in writing to an alternative forum, the federal and state courts of the State of Delaware will be the sole and exclusive forum for: (i) any derivative action or proceeding brought on our behalf; (ii) any action asserting a claim of breach of a fiduciary duty owed by any of our directors, officers, or employees to us or our stockholders; (iii) any action asserting a claim arising pursuant to any provision of the Delaware General Corporation Law; or (iv) any action asserting a claim that is governed by the internal affairs doctrine, in each case subject the court having personal jurisdiction over the indispensable parties named as defendants therein. This exclusive forum provision would not apply to suits brought to enforce any liability or duty created by the Securities Act or the Exchange Act or any other claim for which the federal courts have exclusive jurisdiction. This forum selection provision may limit our stockholders’ ability to bring a claim in a judicial forum that they find favorable for disputes with us or our directors, officers, employees or agents, which may discourage such lawsuits against us and our directors, officers, employees and agents even though an action, if successful, might benefit our stockholders.

Our bylaws establish an advance notice procedure for stockholder proposals to be brought before any meeting of our stockholders, including proposed nominations of persons for election to our board of directors. At an annual or special meeting, stockholders may only consider proposals or nominations (i) specified in the notice of meeting; (ii) brought before the meeting by or at the direction of our board of directors or (iii) otherwise properly brought before the meeting by any stockholder who is a stockholder of record on the date of the giving of the notice and on the record date of the meeting and who complies with the notice procedures set forth in our bylaws. The bylaws do not give our board of directors the power to approve or disapprove stockholder nominations of candidates or proposals regarding other business to be conducted at a special or annual meeting of our stockholders. However, our bylaws may have the effect of precluding the conduct of certain business at a meeting if the proper procedures are not followed. These provisions may also discourage or deter a potential acquirer from conducting a solicitation of proxies to elect the acquirer’s own slate of directors or otherwise attempting to obtain control of the Company.

| 17 |

Delaware Anti-Takeover Statute

We are subject to the provisions of Section 203 of the DGCL regulating corporate takeovers. These provisions can discourage certain coercive and inadequate takeover bids of the Company by requiring those seeking control of the Company to negotiate with the Board of Directors first. In general, Section 203 prohibits a publicly-held Delaware corporation from engaging, under certain circumstances, in a business combination with an interested stockholder (one who owns 15% or more of the Company’s outstanding voting stock) for a period of three years following the date the person became an interested stockholder unless:

| ● | Before the stockholder became an interested stockholder, the board of directors of the corporation approved either the business combination or the transaction which resulted in the stockholder becoming an interested stockholder; | |

| ● | On completion of the transaction that resulted in the stockholder becoming an interested stockholder, the interested stockholder owned at least 85% of the voting stock of the corporation outstanding at the time the transaction commenced with the total number of shares outstanding calculated when the transaction commenced (excluding certain shares owned by officers or directors or under employee stock plans); or | |

| ● | At or subsequent to the time of the transaction, the business combination is approved by the board of directors of the corporation and authorized at an annual or special meeting of stockholders, and not by written consent, by the affirmative vote of at least 66 2/3% of the outstanding voting stock which is not owned by the interested stockholder. |

Generally, a business combination includes a merger, asset or stock sale, or other transaction resulting in a financial benefit to the interested stockholder. We expect the existence of this provision to have an anti-takeover effect with respect to transactions that our Board of Directors does not approve in advance and could result in making it more difficult to accomplish transactions that our stockholders may see as beneficial such as (i) discouraging business combinations that might result in a premium over the market price for the shares of our Common stock; (ii) discouraging hostile takeovers which could inhibit temporary fluctuations in the market price of our Common stock that often result from actual or rumored hostile takeover attempts; and (iii) preventing changes in our management.

Transfer Agent and Registrar