UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D. C. 20549

SCHEDULE 14A

PROXY STATEMENT PURSUANT TO SECTION 14(a)

OF THE SECURITIES EXCHANGE ACT OF 1934

Check the appropriate box:

| [ ] | Preliminary Proxy Statement |

| [ ] | Confidential, for use of the Commission only as permitted by Rule 14a-6(e)(2) |

| [ ] | Definitive Proxy Statement |

| [X] | Definitive Additional Material |

| [ ] | Solicitation Material under §240.14a-12 |

ALGODON

WINES & LUXURY DEVELOPMENT

Group, Inc.

(Name of Registrant as Specified in Its Charter)

Payment of filing fee (Check the appropriate box):

| [X] | No fee required. |

| [ ] | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

| 1) | Title of each class of securities to which transaction applies: | |

| 2) | Aggregate number of securities to which transaction applies: | |

| 3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined): | |

| 4) | Proposed maximum aggregate value of transaction: | |

| 5) | Total fee paid: |

| [ ] | Fee paid with preliminary materials. |

| [ ] | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, of the Form or Schedule and the date of its filing. |

| 1) | Amount Previously Paid: | |

| 2) | Form, Schedule or Registration Statement No.: | |

| 3) | Filing Party: | |

| 4) | Date Filed: |

ALGODON WINES & LUXURY DEVELOPMENT Group, Inc.

135 Fifth Ave., 10th Floor

New York, NY 10010

ANNUAL MEETING OF STOCKHOLDERS

EXPLANATORY NOTE

On July 30, 2018, Algodon Wines & Luxury Development Group Inc. (the “Company” or “Algodon”) filed its Definitive Proxy Statement on Schedule 14A (the “Proxy Statement”) and the related Proxy Cards (the “Proxy Cards”) with the Securities and Exchange Commission for the Company’s 2018 Annual Meeting of Stockholders to be held on September 12, 2018 (the “Annual Meeting”). The Proxy Statement and Proxy Cards requested that the Company’s stockholders approve a reverse stock split of the Company’s common stock ranging from one-for-two (1:2) up to one-for-six (1:6). The Board of Directors, after discussions with Nasdaq, has determined that it should increase the range of the reverse stock split from one-for-two (1:2) up to one one-for-twenty (1:20) in order to provide the Company sufficient flexibility in connection with any potential listing on a national exchange. This supplement includes revisions to the Proxy Statement, an Amended Notice of Annual Meeting, and amended Proxy Cards reflecting the increased range. In addition, the description of Proposal Number Three on page 6 of the Proxy Statement is amended as follows:

| ● | Providing the Board of Directors discretion (if necessary to effect a listing of Algodon’s common stock on a national exchange) on or before June 30, 2019, to implement a reverse stock split of the outstanding shares of common stock in a range from one-for-two (1:2) up to one one-for-twenty (1:20), or anywhere between, while maintaining the number of authorized shares of Common Stock (the “Reverse Stock Split”). A reverse stock split with a range of one post-split share for two pre-split shares (1:2) up to one post-split share for six pre-split shares (1:6) was previously presented and approved at the 2017 Annual Meeting of the Stockholders but the Board of Directors’ discretionary power expired on June 30, 2018 before the Company has been able to uplist on a national exchange. |

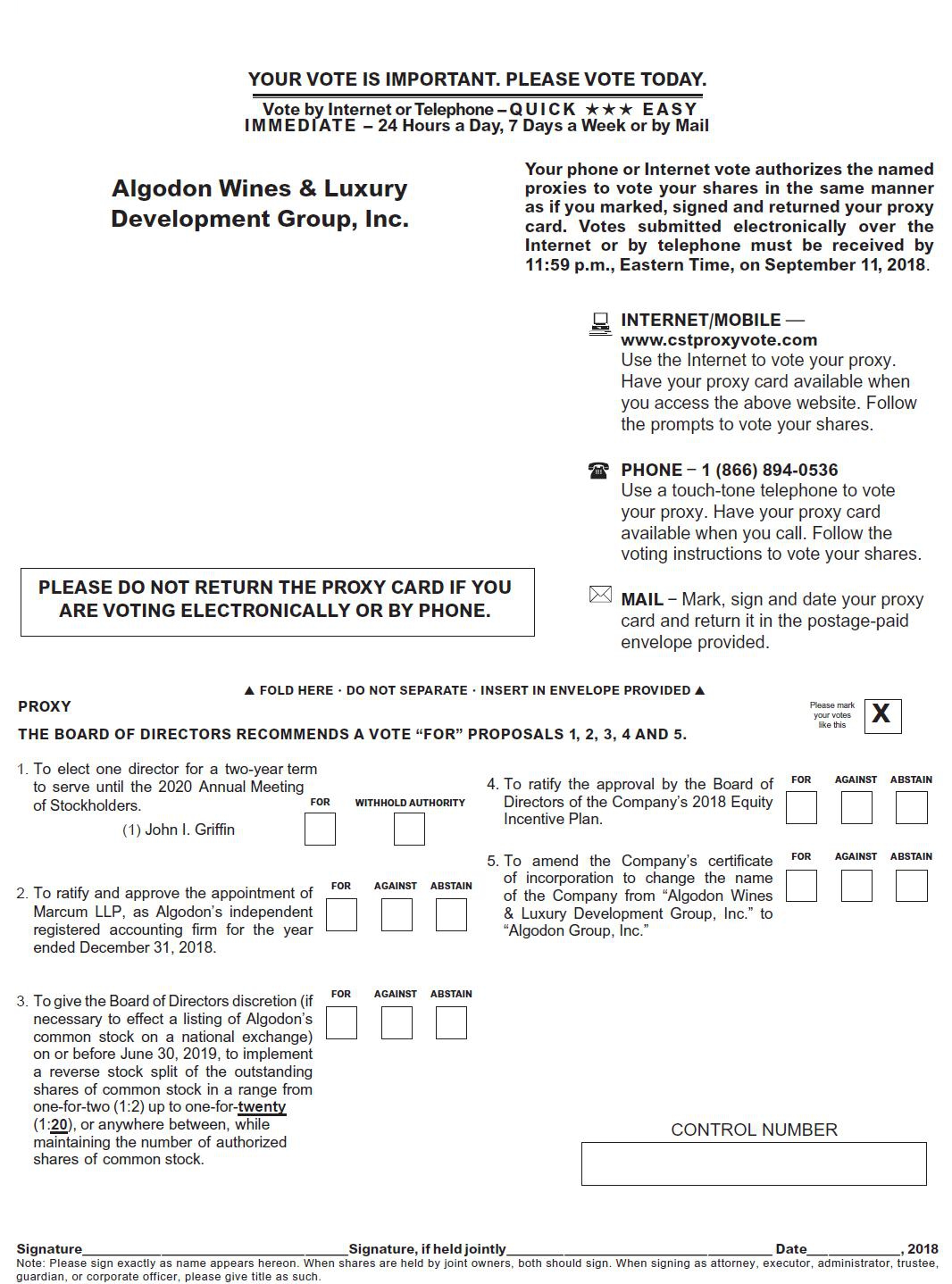

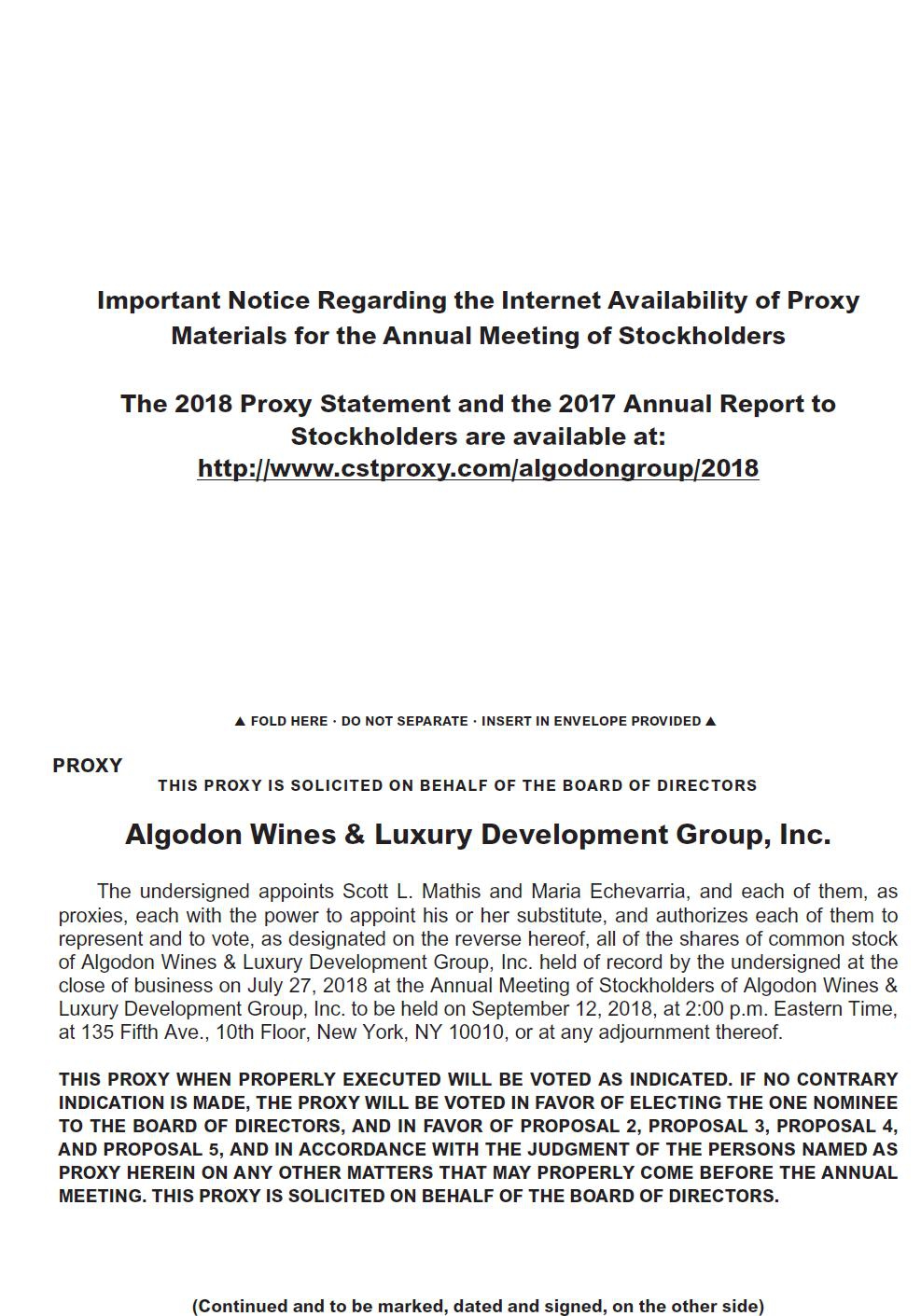

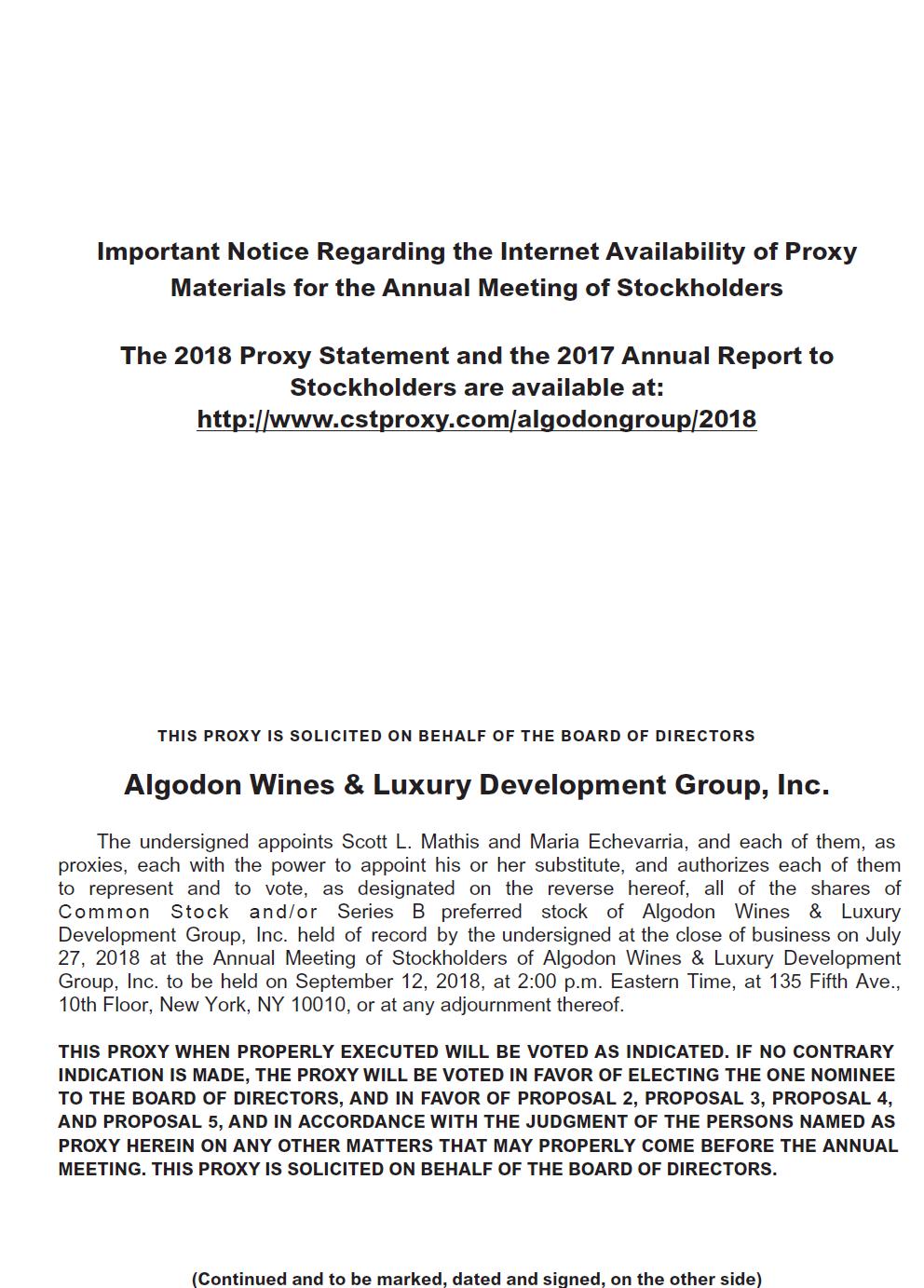

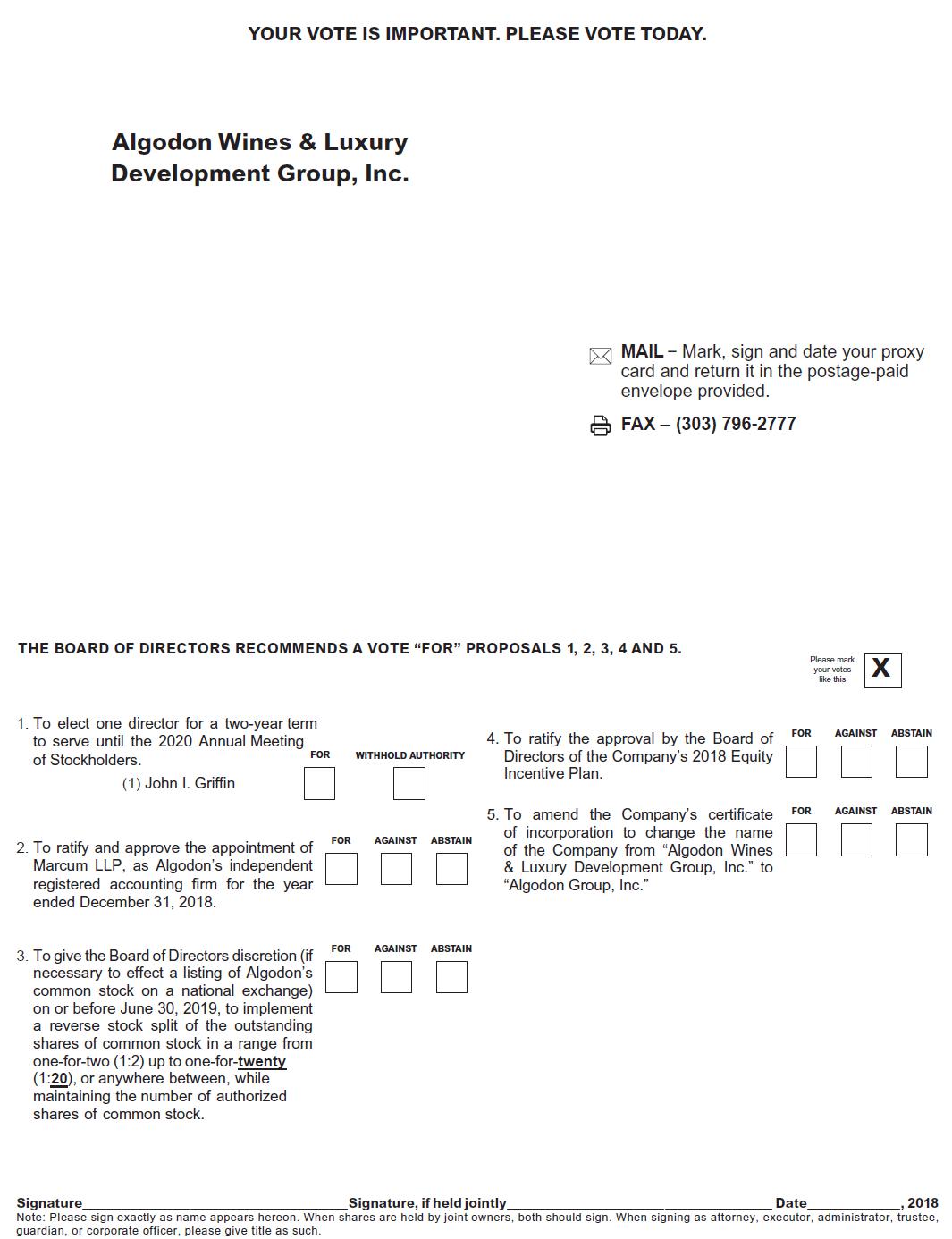

If you have already voted and do not wish to change your vote, you do not need to take any further action. If you have already voted and would like to change your vote or if you have not already voted and would like to do so at this time, you may do so as follows:

| ● | If you are a stockholder of record holding common shares (except with respect to certain common shares described below) you may vote by (i) mailing the enclosed amended Proxy Card, (ii) voting online or via telephone as described on the amended Proxy Card, or (iii) by attending the Annual Meeting in person and voting. | |

| ● | If you are a stockholder of record holding Series B Preferred shares or a stockholder that recently received common shares of the Company you may vote by (i) mailing the enclosed amended Proxy Card, (ii) by faxing the enclosed amended Proxy Card to 303-796-2777, or (iii) by attending the Annual Meeting in person and voting. | |

| ● | If you are a beneficial owner of shares registered in the name of your broker, bank, or other agent, you should follow the instructions on the voting instruction form provided by that organization rather than from the Company. |

If you choose to change your vote, please ensure that you recast your vote on all proposals and not just the amended proposal number three in order for your vote to be counted on all proposals.

PROPOSAL NO. 3

REVERSE STOCK SPLIT

The Board of Directors is considering applying to list Algodon’s common stock ($0.01 par value, 80,000,000 shares authorized, referred to herein as the “Common Stock”) on a national exchange, such as the Nasdaq. One of the requirements under one of the alternative processes for listing on the Nasdaq is that at the time the listing becomes effective, a company’s stock must initially trade at or above $3.00 per share. The Board of Directors believes that a reverse stock split will assist in achieving a price for Algodon Common Stock at or above the $3.00 per share requirement. Therefore, the Board unanimously approved a reverse stock split of all the outstanding shares of Algodon’s Common Stock at an exchange ratio ranging from one post-split share for two pre-split shares (1:2) up to one post-split share for twenty pre-split shares (1:20), or anywhere between those ratios, at the Board’s discretion (the “Reverse Stock Split”) and approved an amendment to Article IV of Algodon’s Amended and Restated Certificate of Incorporation to effect such Reverse Stock Split. The Board noted that it will only effect the Reverse Stock Split in conjunction with a listing on a national exchange. It should be noted that a reverse stock split with a range of one post-split share for two pre-split shares (1:2) up to one post-split share for six pre-split shares (1:6) was presented and approved at the 2017 Annual Meeting of the Stockholders. The reverse stock split with an increased range is being presented again this year in order to reauthorize the Board of Director’s discretion as Algodon continues to seek authorization to list on a national exchange.

Except for adjustments that may result from the treatment of fractional shares, which will be rounded up to the nearest whole number, each stockholder will beneficially hold the same percentage of Common Stock immediately following the Reverse Stock Split as such stockholder held immediately prior to the Reverse Stock Split. Also, proportionate adjustments will be made to the per-share exercise price and the number of shares covered by outstanding options and warrants to buy Common Stock, so that the total prices required to be paid to fully exercise each option and warrant before and after the Reverse Stock Split will be approximately equal. Further, with respect to the Company’s Series B preferred stock, proportionate adjustments will be made to the common stock conversion and voting rights features of that stock to fairly reflect the effect of the Reverse Stock Split.

The Board does not intend as part of the Reverse Stock Split to reduce the amount of the Company’s authorized shares of Common Stock (or of its Series B preferred stock). As of July 18, 2018, the Company has a total of 80,000,000 shares of Common Stock authorized and 46,003,824 shares issued, leaving 33,996,176 shares available for issuance, not including shares reserved for issuance upon conversion of Series B preferred stock, or exercise of warrants or options, or any other convertible security. As a result, the number of unissued, available authorized shares of Common Stock will increase, as reflected in the following table as if the Reverse Stock Split were to occur on July 18, 2018:

| Ratio | Authorized | Issued pre- Reverse Stock Split | Issued post- Reverse | Increase in post- Reverse Stock Split Authorized and Unissued Shares* | ||||||||||||||

| 1:2 | 80,000,000 | 46,003,824 | 23,001,912 | 23,001,912 | ||||||||||||||

| 1:5 | 80,000,000 | 46,003,824 | 9,200,765 | 36,803,059 | ||||||||||||||

| 1:10 | 80,000,000 | 46,003,824 | 4,600,382 | 41,403,442 | ||||||||||||||

| 1:15 | 80,000,000 | 46,003,824 | 3,066,922 | 42,936,902 | ||||||||||||||

| 1:20 | 80,000,000 | 46,003,824 | 2,300,191 | 43,703,633 | ||||||||||||||

*Does not reflect shares reserved for issuance upon conversion of Series B Preferred Stock, exercise of warrants or options, or any other convertible security.

The increase in the number of shares of Common Stock available for issuance and any subsequent issuance of such shares could have the effect of delaying or preventing a change in control of Algodon without further action by the stockholders. The Board is not aware of any attempt to take control of Algodon and has not presented this proposal with the intention that the Reverse Stock Split be used as a type of antitakeover device. Any additional common and preferred stock, when issued, would have the same rights and preferences as the shares of common and preferred stock presently outstanding.

The additional authorized common stock will be available for issuance by the Board for stock splits or stock dividends, acquisitions, raising additional capital, conversion of Algodon debt into equity, stock options or other corporate purposes. Algodon has no plans for the use of any additional shares of common stock except in connection with the exercise of currently outstanding options and warrants. Algodon does not anticipate that it would seek authorization from the stockholders for issuance of such additional shares unless required by applicable law or regulation.

Additional Reasons for the Reverse Stock Split

In addition to the achievement of a stock price required for listing on a national exchange, there are additional reasons the Board believes the Reverse Stock Split will be beneficial to Algodon. One is that the Board believes that the increased market price of the Common Stock expected as a result of implementing the Reverse Stock Split will improve the marketability of the Common Stock and will encourage interest and trading in the Common Stock by brokerage houses and institutions that are not currently able or willing to trade the Common Stock. Because of the trading volatility often associated with low-priced stocks, many potential investors have internal policies and practices that prohibit them from investing in low-priced stocks. Similarly, individual brokers will often not recommend low-priced stocks to their customers. In addition, low-priced stocks not listed on an exchange are subject to the additional broker-dealer disclosure requirements and restrictions found in SEC Rule 15g-6.

It should be noted that the liquidity of the Common Stock may be adversely affected by the Reverse Stock Split given the reduced number of shares that would be outstanding after the Reverse Stock Split. The Board anticipates, however, that the expected higher market price and (if successful) exchange listing will mitigate, to some extent, the effects on the liquidity through the anticipated increase in marketability discussed above.

The Board understands that there is a risk that the market price for the Common Stock may not react proportionally to the Reverse Stock Split. For example, if Algodon accomplishes a 1:3 Reverse Stock Split at a time when the market price is $1.50 per share, there can be no assurance that the resulting market price will thereafter remain at or above $4.50 per share (three times the previous market price).

The Board confirms that the contemplated Reverse Stock Split is not and will not be the first step in a series of plans or proposals of a “going private transaction” within the meaning of Rule 13e-3 of the Exchange Act.

Based upon the foregoing factors and understanding the risks, the Board has determined that the Reverse Stock Split is in the best interests of the Company and its stockholders.

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS A VOTE TO give THE Board of Directors discretion (if necessary to effect a listing of Algodon’s common stock on a national exchange) on or before June 30, 2019, to implement a reverse stock split of the outstanding shares of common stock in a range from one-for-two (1:2) up to one-for-TWENTY (1:20), or anywhere IN between, while maintaining the number of authorized shares of Common Stock.

ALGODON WINES & LUXURY DEVELOPMENT Group, Inc.

135 Fifth Ave., 10th Floor

New York, NY 10010

AMENDED NOTICE OF ANNUAL MEETING OF STOCKHOLDERS AND IMPORTANT NOTICE REGARDING THE AVAILABILITY OF THE COMPANY’S PROXY STATEMENT

On September 12, 2018

To our Stockholders:

You are cordially invited to attend the Annual Meeting of Stockholders of Algodon Wines & Luxury Development Group, Inc. (“Algodon”) on September 12, 2018, at 2:00 p.m. Eastern Time, at 135 Fifth Ave., 10th Floor, New York, NY 10010 (the “Annual Meeting”). At the Annual Meeting the Company will submit the following five (5) proposals to its stockholders for approval:

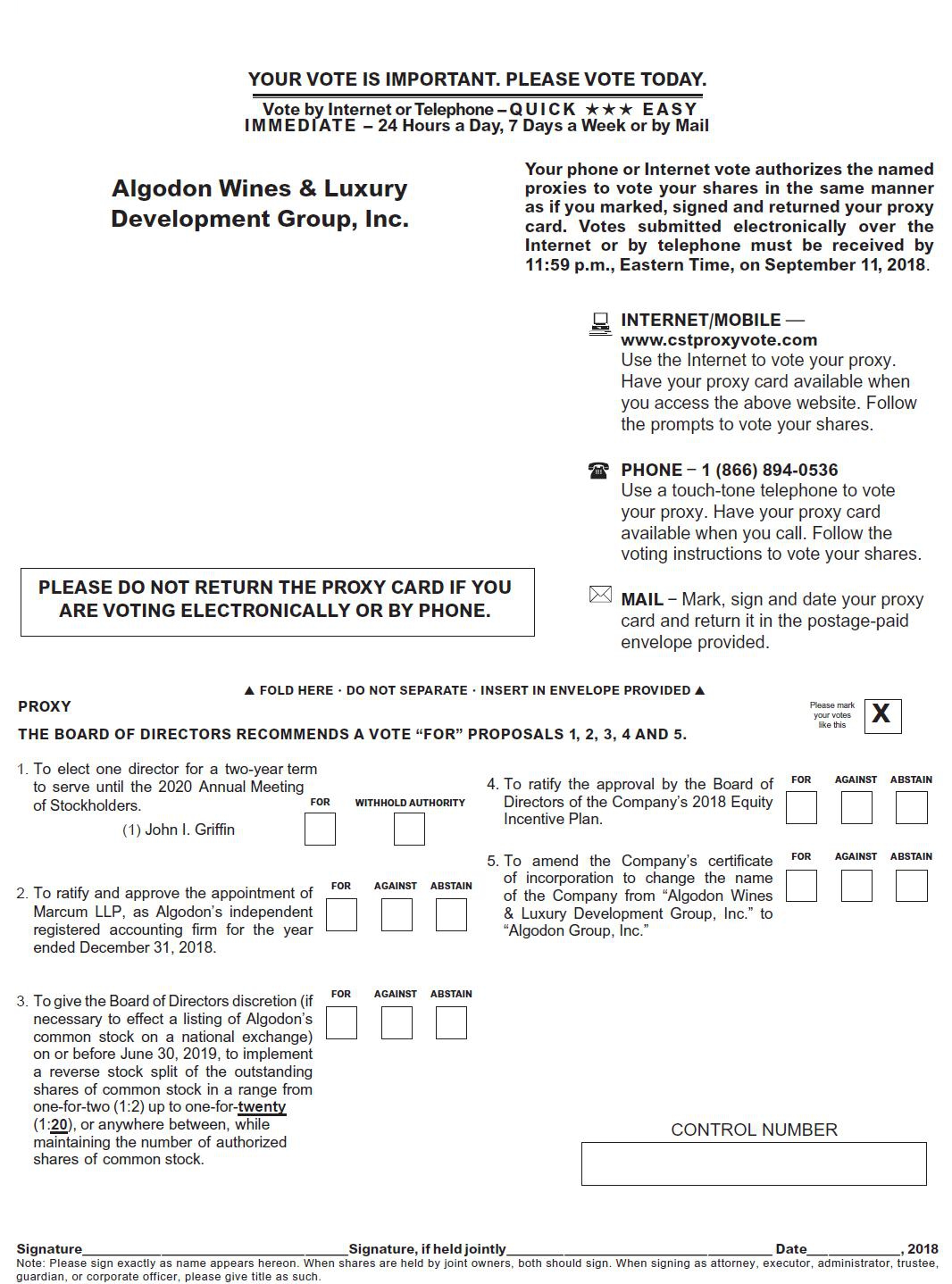

| 1. | To elect one director for a two-year term to serve until the 2020 Annual Meeting of Stockholders. | |

| 2. | To ratify and approve the appointment of Marcum LLP, as Algodon’s independent registered accounting firm for the year ended December 31, 2018. | |

| 3. | To reauthorize granting the Board of Directors discretion (if necessary to effect a listing of Algodon’s common stock on a national exchange) on or before June 30, 2019, to implement a reverse stock split of the outstanding shares of common stock in a range from one-for-two (1:2) up to one one-for-twenty (1:20), or anywhere in between, while maintaining the number of authorized shares of Common Stock (the “Reverse Stock Split”). This item was previously presented and approved at the 2017 Annual Meeting of the Stockholders but the Board of Directors’ discretionary power expired on June 30, 2018 before the Company has been able to uplist on a national exchange. | |

| 4. | To ratify the approval by the Board of Directors of the Company’s 2018 Equity Incentive Plan. | |

| 5. | To amend the Company’s certificate of incorporation to change the name of the Company from “Algodon Wines & Luxury Development Group, Inc.” to “Algodon Group, Inc.” |

Additionally, any other business that may properly come before the Annual Meeting will be conducted.