U.S. SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10

Amendment No. 3

General Form for Registration of Securities

Pursuant to Section 12(b) or 12(g)

of the Securities Exchange Act of 1934

or

Algodon Wines & Luxury Development Group, Inc.

(Exact name of Registrant as specified in its charter)

| Delaware | 52-2158952 | |

(State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification Number) |

135 Fifth Avenue, Floor 10

New York, NY 10010

Phone: 212-739-7700

(Address and telephone number of Registrant’s principal executive offices)

Securities registered or to be registered pursuant to Section 12(b) of the Act:

| Title of Each Class: | Name of Each Exchange On Which Registered: | |

| None | None |

Securities registered or to be registered pursuant to Section 12(g) of the Act:

Common Stock, par value $0.01

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer | ¨ | Accelerated filer | ¨ |

| Non-accelerated filer | ¨ | Smaller reporting company | R |

EXPLANATORY NOTE

We are filing this Amendment No. 3 to the initial Registration Statement on Form 10 that we filed with the Securities and Exchange Commission (the “SEC”) on May 14, 2014 (the “Initial Form 10”), to include our financial statements for the six months ended June 30, 2014 and to revise certain disclosure pursuant to comments we received from the SEC regarding the Initial Form 10 and the Amendment No. 1 to the Initial Form 10 as filed with the SEC on July 3, 2014 and the Amendment No. 2 to the Initial Form 10 as filed with the SEC on August 13, 2014.

Algodon Wines & Luxury Development Group, Inc. is filing this registration statement on Form 10 (the “Registration Statement”) under the Securities Exchange Act of 1934, as amended (the “Exchange Act”) on a voluntary basis to provide current public information to the investment community and to comply with applicable requirements for the quotation or listing of its securities on a national securities exchange or other public trading market. In this Registration Statement, the terms “Company,” “AWLD,” “we,” “us,” and “our” refer to Algodon Wines & Luxury Development Group, Inc. and its subsidiaries. We refer to our $.01 par value common stock as our common stock.

Once this Registration Statement is deemed effective, we will be subject to the requirements of Section 13(a) of the Exchange Act, including the rules and regulations promulgated thereunder, which will require us to file annual reports on Form 10-K, quarterly reports on Form 10-Q, and current reports on Form 8-K, and we will be required to comply with all other obligations of the Exchange Act applicable to issuers filing registration statements pursuant to Section 12(g) of the Exchange Act.

Special Note—Forward-Looking Statements

This Registration Statement contains forward-looking statements that involve risks and uncertainties. These forward-looking statements relate to, among other things, the expected timetable for development of the Company’s various projects and investments, growth strategy, and future financial performance, including operations, economic performance, financial condition, prospects, and other future events. AWLD and its management have attempted to identify forward-looking statements by using such words as “anticipates,” “believes,” “can,” “continue,” “could,” “estimates,” “expects,” “intends,” “may,” “plans,” “potential,” “should,” “will,” or other similar expressions. These forward-looking statements are only predictions and are largely based on current expectations. These forward-looking statements appear in a number of places in this Registration Statement.

In addition, a number of known and unknown risks, uncertainties, and other factors could affect the accuracy of these statements. We have included the known material risks as outlined under “Item 1A. Risk Factors” and elsewhere in this Registration Statement.

Important factors to consider in evaluating forward-looking statements include:

| • | the risks and additional expenses associated with international operations and operations in a country (Argentina) which has had significantly high inflation in the past and is reflected in recent reports as having substantial political risk factors; |

| • | the risks associated with a start-up business that has never been profitable and has significant working capital needs; |

| • | the possibility of external factors preventing or delaying the acquisition, development or expansion of real estate projects; |

| • | changes in external market factors; |

| • | changes in the industry’s overall performance; |

| • | changes in business strategies; |

| • | possible inability to execute the Company’s business strategies due to industry changes or general changes in the economy generally; |

| 2 |

| • | changes in productivity and reliability of third parties, counterparties, joint venturers, suppliers or contractors; and |

| • | the success of competitors and the emergence of new competitors. |

Although AWLD currently believes that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, levels of activity or performance. AWLD does not expect to update any of the forward-looking statements after the date of this Registration Statement or to conform these statements to actual results, except as may be required by law. You should not place undue reliance on forward-looking statements contained in this Registration Statement.

Industry and Market Data

Information about market and industry statistics contained in this Registration Statement is included based on information available to AWLD that it believes is complete and accurate in all material respects. It is generally based on third-party publications that are not produced for purposes of securities offerings or economic analysis and not prepared for or commissioned by AWLD or its affiliates. Forecasts and other forward-looking information obtained from these sources, including estimates of future market size, revenue and market acceptance of projects, services and investment opportunities, are subject to the same qualifications and the additional uncertainties accompanying any forward-looking statements.

SUMMARY

The following summary contains the material information about this Registration Statement. For a more complete understanding of this Registration Statement, we encourage you to read this entire Registration Statement and the documents that are referred to in this Registration Statement, together with any accompanying supplements.

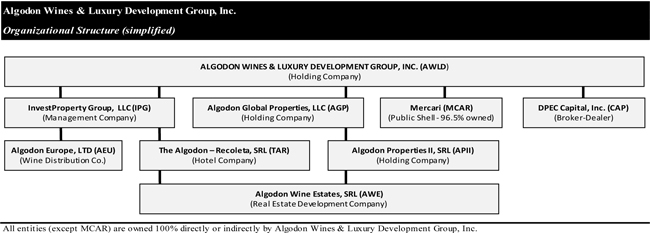

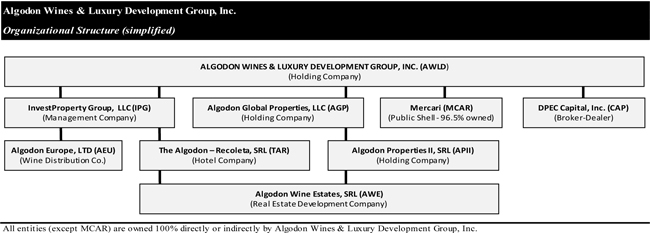

Company Structure and History

AWLD conducts most of its business operations and holds assets through various subsidiaries. To avoid confusion among the various entities referred to and described in this Registration Statement, unless otherwise indicated, the terms “AWLD,” “Company,” “we,” “us,” and “our” refer to Algodon Wines & Luxury Development Group, Inc. and its subsidiaries. The term “Parent” refers to the single entity, Algodon Wines & Luxury Development Group, Inc.

AWLD is a company whose primary focus is to create, develop, market and manage real estate assets in Argentina. Currently, AWLD invests in, develops, and operates a hotel, vineyard and producing winery, and a golf and tennis resort located in Argentina. AWLD is also active in acquiring additional real estate located near the resort and developing the property for residential development.

The Company’s other operations are positioned to promote and enhance the ALGODON ® brand and facilitate its real estate development operation. In addition to its real estate, resort development, and wine production businesses, AWLD owns a broker-dealer that is registered under the Securities Exchange Act of 1934 and is a member of the Financial Industry Regulatory Authority (“FINRA”) with a traditional retail commission-based business that specializes in offering private placement, venture capital-type opportunities in AWLD projects.

AWLD also holds as one of its assets, a public reporting shell corporation that is current in its reporting obligations under the Securities Exchange Act of 1934 and a ready target for merger or sale. The shell corporation is consolidated with AWLD and its assets and liabilities are de minimis.

The Parent is a Delaware corporation formed on April 5, 1999 under the name “Investprivate.com, Inc.” and was originally conceived as an Internet-based brokerage firm, the mission of which was to provide entrepreneurial and institutional investment opportunities to qualified or accredited investors to whom such opportunities historically were largely unavailable. On February 9, 2001, the Parent changed its name to “InvestPrivate Holdings Corp.” and created its broker dealer subsidiary and began to expand its business model in specific market sectors where it focused on creating and financing various operating businesses. On October 15, 2002, the Parent changed its name to “Diversified Biotech Holdings Corp.”

| 3 |

On February 22, 2007, the Parent changed its name to “Diversified Private Equity Corp.” in order to reflect AWLD’s evolution from an Internet-based brokerage firm into a retail brokerage firm focusing on the marketing of private offerings and a developer of real estate projects in Argentina. AWLD has transitioned from a diversified private equity platform to a luxury real estate development company under the “Algodon” brand, and is now more widely recognized as “Algodon” than as DPEC. Thus, on October 1, 2012, the Parent changed its name to “Algodon Wines & Luxury Development Group, Inc.” which better describes AWLD’s current operating business and better reflects its trajectory. “Algodon” is the name that most of AWLD’s investors and customers are familiar with.

From AWLD’s inception, its goal to its investors has consistently been to provide entrepreneurial and institutional investment opportunities to qualified or accredited investors to whom such opportunities historically were unavailable. Under current SEC regulations, a large number of accredited investors in the United States can participate in the private equity products that AWLD offers, and management believes that the investment products it structures will be attractive to qualified investors.

The current corporate organizational structure of AWLD and how we have operated substantially for the past year appears below.

RISK FACTORS

An investment in our securities involves certain risks relating to our structure and investment objective. The risks set forth below are the risks we have identified and which we currently deem material or predictable. In general, you take more risk when you invest in the securities of issuers in emerging markets such as Argentina than when you invest in the securities of issuers in the United States. If any of the following risks occur, our business, financial condition and results of operations could be materially adversely affected. In such case, our net asset value and the price of our common stock could decline, and you may lose all or part of your investment.

In evaluating the Company, its business and any investment in the Company, readers should carefully consider the following factors:

Risks Relating to Argentina

Economic and Political Risks Specific to Argentina

The Argentinian economy has been characterized by frequent and occasionally extensive intervention by the Argentinian government and by unstable economic cycles. The Argentinian government has often changed monetary, taxation, credit, tariff and other policies to influence the course of Argentina’s economy, and taken other actions which do, or are perceived to weaken the nation’s economy especially as it relates to foreign investors and other overall investment climate. For example, in 2008, the Argentine government assumed control over approximately $30 billion held in private pension funds, which caused a significant temporary decline in the Argentine stock market, a decline in the Argentine peso and prompted Standard & Poor’s to downgrade Argentina’s credit rating. The Argentine peso has devalued significantly against the U.S. dollar, from about 6.1 Argentine pesos per dollar in December 2013 to about 8.0 pesos per dollar in May 2014. The Argentine government has also instituted foreign exchange controls which may make foreign investment into Argentina to be less attractive.

| 4 |

The overall state of Argentinian politics and the Argentina economy have resulted in numerous investment reports that warn about foreign investment in Argentina. Investors considering an investment in AWLD should be mindful of these potential political and financial risks.

Argentina’s economy may not support foreign investment or our business.

The Argentine economy has experienced significant volatility in recent decades, characterized by periods of low or negative growth, high inflation and currency deflation. Currently there is significant inflation, labor unrest, and currency deflation. There has also been significant governmental intervention into the Argentine economy, including price controls and foreign currency restrictions. As a result, uncertainty remains as to whether economic growth in Argentina is sustainable and whether foreign investment will be successful.

Recent efforts by Argentina to nationalize businesses.

In April 2012, Argentine President Cristina Fernández announced her decision to nationalize YPF, the country’s largest oil company, from its majority stakeholder, thus contributing to declining faith from foreign investors in the country and again resulting in a downgrade by Standard and Poor’s of Argentina’s economic and financial outlook to “negative”. There have been other discussions in Argentina about the possibility of nationalizing other businesses and industries, and there is no assurance that any investment in AWLD will be safe from government control or nationalization.

Continuing inflation may have an adverse effect on the economy.

The devaluation of the Argentine peso in January 2002 created pressures on the domestic price system that generated high inflation throughout 2002, before inflation stabilized in 2003. According to the National Institute of Statistics and Census (“Instituto Nacional de Estadísticas y Censos” or the “INDEC”), inflation was nearly 26% in 2012. Official sources list inflation in 2013 at 10.9%, but private estimates put it above 25%. According to news reports, the new index showed inflation of 3.7% in January 2014, although analysts in a Reuters survey estimated a rate of 5.6%. In February, the government measured inflation at 3.4% versus the 4.2% in the Reuters survey. In March 2014 the official rate of 2.6% was closer to the 3.0% in the Reuters survey and the 3.3% percent offered in a separate poll published by Argentina’s Congress. INDEC figures put inflation in April at 1.8%; May at 1.4%; June at 1.3%; and July at 1.4% for total inflation in the first seven months of 2014 of 16.7%. In a recent Reuters poll, estimates for the June inflation rate ranged from 0.8% to 2.3% for an average of 1.8% and estimates for the July inflation rate were 1.5%. Private estimates of inflation during 2014 now project inflation at approximately 30%. The high inflation rate has resulted in nationwide strikes, devaluation of the Argentine peso in January 2014, and a price control program. The uncertainty surrounding the Argentine economy and future inflation may impact the country’s growth.

In the past, inflation has undermined the Argentine economy and the government’s ability to create conditions conducive to growth. A return to a high inflation environment would adversely affect the availability of long-term credit and the real estate market and may also affect Argentina’s foreign competitiveness by diluting the effects of the peso devaluation and negatively impacting the level of economic activity and employment.

Additionally, high inflation would also undermine Argentina’s foreign competitiveness and adversely affect economic activity, employment, real salaries, consumption and interest rates. In addition, the dilution of the positive effects of the peso devaluation on the export-oriented sectors of the Argentine economy will decrease the level of economic activity in the country. In turn, a portion of the Argentine debt is adjusted by the Coefciente de Estabilización de Referencia, (the “Stabilization Coefficient Index, or “CER Index”), a currency index that is strongly tied to inflation. Therefore, any significant increase in inflation would cause an increase in Argentina’s debt and, consequently, the country’s financial obligation.

| 5 |

If inflation remains high or continues to rise, Argentina’s economy may be negatively impacted and our business could be adversely affected. Periods of higher inflation may slow the rate of growth of the Argentinian economy which in turn would likely increase the Company’s costs and expenses, reduce its profitability and adversely affect its financial performance.

A highly inflationary economy is defined as an economy with a cumulative inflation rate of approximately 100 percent or more over a three-year period. If a country’s economy is classified as highly inflationary, the functional currency of the foreign entity operating in that country must be remeasured to the functional currency of the reporting entity. The estimated cumulative three-year inflation rate for Argentina by the end of 2013 is 34%.

Argentina’s ability to obtain financing from international markets is limited, which may impair its ability to implement reforms and foster economic growth.

After the economic crisis in 2002, the Argentine government has maintained a policy of fiscal surplus. To be able to repay its debt, the Argentine government may be required to continue adopting austere fiscal measures that could adversely affect economic growth.

In 2005 and 2010, Argentina restructured over 91% of its sovereign debt that had been in default since the end of 2001. Some of the creditors who did not participate in the 2005 or 2010 exchange offers continued their pursuit of a legal action against Argentina for the recovery of debt.

In April 2010, a New York court granted an attachment over reserves of the Argentine Central Bank in the United States requested by creditors of Argentina on the basis that the Central Bank was its alter ego. In subsequent court rulings Argentina was ordered to pay $1.33 billion to hedge fund creditors who refused to participate in the debt restructuring along with those who did. In February 2014, Argentina filed an appeal to the U.S. Supreme Court seeking to reverse these lower court decisions but the U.S. Supreme Court declined to consider Argentina’s appeal.

A U.S. Court of Appeals blocked the most recent debt payment made by Argentina in June 2014 because it was improperly structured, giving Argentina through the end of July 2014 to find a way to pay to fulfill its obligations. On or about July 30, 2014, credit rating agencies Fitch and S&P declared Argentina to be in “selective default” after a U.S. judge blocked trustee Bank of New York Mellon from making payments to Argentine bond holders, after Argentina deposited the $539 million in funds due to bond holders with the trustee. The court’s reason for blocking the payments was due to Argentina failing to reach an agreement with a group of hedge funds that are holding out for better terms on old Argentine defaulted debt. In August 2014, Argentina filed a petition with the International Court of Justice against the United States alleging that U.S. courts have violated its sovereignty with respect to payments to Argentina’s creditors. In order for the suit to proceed, the U.S. would have to consent to jurisdiction, which may be unlikely.

As a result of Argentina’s default and its aftermath of litigation, the government may not have the financial resources necessary to implement reforms and foster economic growth, which, in turn, could have a material adverse effect on the country’s economy and, consequently, our businesses and results of operations. Furthermore, Argentina’s inability to obtain credit in international markets could have a direct impact on our own ability to access international credit markets to finance our operations and growth.

There can be no assurance that the Argentine government will not truly default (as opposed to the current technical default) on its obligations under its bonds if it experiences another economic crisis. A new default by the Argentine government could lead to a new recession, higher inflation, restrictions on Argentine companies to access financing and funds, limit the operations of Argentine companies in the international markets, higher unemployment and social unrest, which would negatively affect our financial condition, results of operations and cash flows.

The Argentine government has placed currency limitations on withdrawals of funds.

The Argentine government, led by populist president Cristina Fernández, has instituted economic controls that include limiting the ability recently of individuals and companies to exchange local currency (Argentine peso) into U.S. dollars and to transfer funds out of the country. Public reports state that government officials are micromanaging money flows by limiting dollar purchases and discouraging dividend payments and international wire transfers. As a result of these controls, Argentine companies currently have limited access to U.S. dollars through regular channels (e.g., banks) and consumers are facing difficulty withdrawing and exchanging invested funds. Given the Company’s investment in Argentinian projects and developments, its ability to mobilize and access funds may be affected by the above-mentioned political actions.

| 6 |

The Argentine government may, in the future, impose additional controls on the foreign exchange market and on capital flows from and into Argentina, in response to capital flight or depreciation of the peso. These restrictions may have a negative effect on the economy and on our business if imposed in an economic environment where access to local capital is constrained.

The stability of the Argentine banking system is uncertain.

Adverse economic developments, even if not related to or attributable to the financial system, could result in deposits flowing out of the banks and into the foreign exchange market, as depositors seek to shield their financial assets from a new crisis. Any run on deposits could create liquidity or even solvency problems for financial institutions, resulting in a contraction of available credit.

In the event of a future shock, such as the failure of one or more banks or a crisis in depositor confidence, the Argentine government could impose further exchange controls or transfer restrictions and take other measures that could lead to renewed political and social tensions and undermine the Argentine government’s public finances, which could adversely affect Argentina’s economy and prospects for economic growth which could adversely affect our business.

Government measures to preempt or respond to social unrest may adversely affect the Argentine economy and our business.

The Argentine government has historically exercised significant influence over the country’s economy. Additionally, the country’s legal and regulatory frameworks have at times suffered radical changes, due to political influence and significant political uncertainties. In April 2014, there were nationwide strikes that paralyzed the Argentine economy, shutting down air, train and bus traffic, closing businesses and ports, emptying classrooms, shutting down non-emergency hospital attention and leaving trash uncollected. This is consistent with past periods of significant economic unrest and social and political turmoil.

Future government policies to preempt, or in response to, social unrest may include expropriation, nationalization, forced renegotiation or modification of existing contracts, suspension of the enforcement of creditors’ rights, new taxation policies, including royalty and tax increases and retroactive tax claims, and changes in laws and policies affecting foreign trade and investment. Such policies could destabilize the country and adversely and materially affect the economy, and thereby our business.

The Argentine economy could be adversely affected by economic developments in other global markets.

Financial and securities markets in Argentina are influenced, to varying degrees, by economic and market conditions in other global markets. Although economic conditions vary from country to country, investors’ perception of the events occurring in one country may substantially affect capital flows into other countries. Lower capital inflows and declining securities prices negatively affect the real economy of a country through higher interest rates or currency volatility.

In addition, Argentina is also affected by the economic conditions of major trade partners, such as Brazil and/or countries that have influence over world economic cycles, such as the United States. If interest rates rise significantly in developed economies, including the United States, Argentina and other emerging market economies could find it more difficult and expensive to borrow capital and refinance existing debt, which would negatively affect their economic growth. In addition, if these developing countries, which are also Argentina’s trade partners, fall into a recession the Argentine economy would be affected by a decrease in exports. All of these factors would have a negative impact on us, our business, operations, financial condition and prospects.

| 7 |

The Argentine government may order salary increases to be paid to employees in the private sector, which would increase our operating costs.

There have been recent nationwide strikes in Argentina over wages and benefits paid to workers which workers believe to be inadequate in light of the high rate of inflation. In the past, the Argentine government has passed laws, regulations and decrees requiring companies in the private sector to maintain minimum wage levels and provide specified benefits to employees and may do so again in the future. In the aftermath of the Argentine economic crisis, employers both in the public and private sectors have experienced significant pressure from their employees and labor organizations to increase wages and to provide additional employee benefits. Due to the high levels of inflation, the employees and labor organizations have begun again demanding significant wage increases. It is possible that the Argentine government could adopt measures mandating salary increases and/or the provision of additional employee benefits in the future. Any such measures could have a material and adverse effect on our business, results of operations and financial condition.

Restrictions on the supply of energy could negatively affect Argentina’s economy.

As a result of a prolonged recession, and the forced conversion into pesos and subsequent freeze of gas and electricity tariffs in Argentina, there has been a lack of investment in gas and electricity supply and transport capacity in Argentina in recent years. At the same time, demand for natural gas and electricity has increased substantially, driven by a recovery in economic conditions and price constraints, which has prompted the government to adopt a series of measures that have resulted in industry shortages and/or cost increases.

The federal government has been taking a number of measures to alleviate the short-term impact of energy shortages on residential and industrial users. If these measures prove to be insufficient, or if the investment that is required to increase natural gas production and transportation capacity and energy generation and transportation capacity over the medium-and long-term fails to materialize on a timely basis, economic activity in Argentina could be limited, which could have a significant adverse effect on our business.

Real Estate Considerations and Risks Associated with the International Projects that AWLD Operates

The Real Estate Industry and International Investing

Investments in real estate are subject to numerous risks, including the following:

| · | Increased expenses and uncertainties related to international operations; |

| · | Risks associated with Argentina’s past political uncertainties, economic crises, and high inflation; |

| · | Risks associated with currency, exchange, and import/export controls; |

| · | Adverse changes in national or international economic conditions; |

| · | Adverse local market conditions; |

| · | Construction and renovation costs exceeding original estimates; |

| · | Price increases in basic raw materials used in construction; |

| · | Delays in construction and renovation projects; |

| · | Changes in availability of debt financing; |

| · | Risks due to dependence on cash flow; |

| · | Changes in interest rates, real estate taxes and other operating expenses; |

| · | Changes in the financial condition of tenants, buyers and sellers of properties; |

| · | Competition with others for suitable properties; |

| · | Changes in environmental laws and regulations, zoning laws and other governmental rules and fiscal policies; |

| · | Changes in energy prices; |

| · | Changes in the relative popularity of properties; |

| · | Risks related to the potential use of leverage; |

| · | Costs associated with the need to periodically repair, renovate and re-lease space; |

| · | Increases in operating costs including real estate taxes; |

| · | Risks and operating problems arising out of the presence of certain construction materials; |

| · | Environmental claims arising in respect of real estate acquired with undisclosed or unknown environmental problems or as to which inadequate reserves had been established; |

| · | Uninsurable losses and acts of terrorism; |

| · | Acts of God; and |

| · | Other factors beyond the control of the Company. |

| 8 |

Investment in Argentine real property is subject to economic and political risks.

Investment in foreign real estate requires consideration of certain risks typically not associated with investing in the United States. Such risks include, among other things, trade balances and imbalances and related economic policies, unfavorable currency exchange rate fluctuations, imposition of exchange control regulation by the United States or foreign governments, United States and foreign withholding taxes, limitations on the removal of funds or other assets, policies of governments with respect to possible nationalization of their industries, political difficulties, including expropriation of assets, confiscatory taxation and economic or political instability in foreign nations or changes in laws which affect foreign investors. Any one of these risks has the potential to reduce the value of our real estate holdings in Argentina and have a material adverse effect on the Company’s financial condition.

The real estate market is highly competitive in Argentina.

Due to a scarcity of properties in sought-after locations and the increasing number of local and international competitors, the real estate market in Argentina is highly competitive. Furthermore, the Argentinian real estate industry is generally fragmented and does not have high-entry barriers restricting new competitors from entering the market. The main competitive factors in the real estate development business include availability and location of land, price, funding, design, quality, reputation and partnerships with developers. A number of residential and commercial developers and real estate services companies will compete with the Company in seeking land for acquisition, financial resources for development and prospective purchasers. Other companies, including joint ventures of foreign companies and local companies have become increasingly active in the real estate business in Argentina, further increasing this competition. To the extent that one or more of the Company’s competitors are able to acquire and develop desirable properties, as a result of greater financial resources or otherwise, the Company’s business could be materially and adversely affected. If the Company is not able to respond to such pressures as promptly as its competitors, or should the level of competition increase, its financial position and results of operations could be adversely affected.

There are limitations on the ability of foreign persons to own Argentinian real property.

In December 2011, the Argentine Congress passed Law 26.737 (Regime for Protection of National Domain over Ownership, Possession or Tenure of Rural Land) limiting foreign ownership of rural land, even when not in border areas, to a maximum of 15 percent of all national, provincial or departmental productive land. Every non-Argentine national must request permission from the National Land Registry of Argentina in order to acquire non-urban real property.

As approved, the law has been in effect since February 28, 2012 but is not retroactive. Furthermore, the general limit of 15 percent ownership by non-nationals must be reached before the law is applicable and each provincial government may establish its own maximum area of ownership per non-national.

In the Mendoza province, the maximum area allowed per type of production and activity per non-national is as follows: Mining—25,000 hectares (6,1776 acres), cattle ranching—18,000 hectares (44,479 acres), cultivation of fruit or vines—15,000 hectares (37,066 acres), horticulture—7,000 hectares (17,297 acres), private lot—200 hectares (494 acres), and other—1,000 hectares (2,471 acres). A hectare is a unit of area in the metric system equal to approximately 2.471 acres. However, these maximums will only be considered if the total 15 percent is reached. Although currently, the area under foreign ownership in Mendoza is approximately 8.6 percent and the total land held for cultivation of fruit or wines by the Company is 834 hectares, this law may apply to the Company in the future, and could affect the Company’s ability to acquire additional real property in Argentina. The inability to acquire additional land could curtail the Company’s growth strategy.

There may be a lack of liquidity in the underlying real estate.

Because a substantial part of the assets managed by the Company will be invested in illiquid real estate, there is a risk that the Company will be unable to realize its investment objectives through the sale or other disposition of properties at attractive prices or to do so at a desirable time. This could hamper the Company’s ability to complete any exit strategy with regard to investments it has structured or participated in.

| 9 |

There is limited public information about real estate in Argentina.

There is generally limited publicly available information about real estate in Argentina, and the Company will be conducting its own due diligence on future transactions. Moreover, it is common in Argentinian real estate transactions that the purchaser bears the burden of any undiscovered conditions or defects and has limited recourse against the seller of the property. Should the pre-acquisition evaluation of the physical condition of any future investments have failed to detect certain defects or necessary repairs, the total investment cost could be significantly higher than expected. Furthermore, should estimates of the costs of developing, improving, repositioning or redeveloping an acquired property prove too low or estimates of the market demand or the time required to achieve occupancy prove too optimistic, the profitability of the investment may be adversely affected.

Our construction projects may be subject to delays in completion.

Algodon Mansion and Algodon Wine Estates have each required significant redevelopment construction (including potentially building residential units for Algodon Wine Estates). The quality of the construction and the timely completion of these projects are factors affecting operations and significant delays or cost overruns could materially adversely affect the Company’s operations. Delays in construction or defects in materials and/or workmanship have occurred and may continue to occur. Defects could delay completion of one or all of the projects or, if such defects are discovered after completion, expose the Company to liability. In addition, construction projects may also encounter delays due to adverse weather conditions, natural disasters, fires, delays in the provision of materials or labor, accidents, labor disputes, unforeseen engineering, environmental or geological problems, disputes with contractors and subcontractors, or other events. If any of these materialize, there may be a delay in the commencement of cash flow and/or an increase in costs that may adversely affect the Company.

The Company may be subject to certain losses that are not covered by insurance.

AWLD, its affiliates and/or subsidiaries currently maintain insurance coverage against liability to third parties and property damage as is customary for similarly situated businesses, however the Company does not hold any country-risk insurance. There can be no assurance, however, that insurance will continue to be available or sufficient to cover any such risks. Insurance against certain risks, such as earthquakes, floods or terrorism may be unavailable, available in amounts that are less than the full market value or replacement cost of the properties or subject to a large deductible. In addition, there can be no assurance the particular risks which are currently insurable will continue to be insurable on an economic basis.

The Company often enters into joint ventures to develop its projects in which the Company does not have complete control.

The Company or one or more of its affiliates may acquire, develop or redevelop projects through joint ventures with third parties. Joint venturers often share control over the operation of the joint venture assets. Joint venture partners might have economic or business objectives that are inconsistent with the Company’s objectives. Joint venture partners could go bankrupt, leaving the Company or one of its affiliates liable for their share of joint venture liabilities. Although the Company will generally seek to maintain sufficient control of any joint venture to permit its objectives to be achieved, it might not be able to take action without the approval of the joint venture partners. In addition, the Company’s joint venture partners could take actions binding on the joint venture without the Company’s consent. Any potential dispute with a joint venture partner would likely be subject to foreign jurisdiction in which the Company, its affiliate or the Company would be the non-local party and would likely result in significant costs and disruption of management attention. Accordingly, the use of joint ventures could present additional risk to the business model.

Boutique Hotel

In addition to the risks that apply to all real estate investments, hotel and hospitality investments are subject to additional risks which include:

| · | Competition for guests from other hotels based upon brand affiliations, room rates offered including those via internet wholesalers and distributors, customer service, location and the condition and upkeep of each hotel in general and in relation to other hotels in their local market; |

| · | Specific competition from well-established operators of “boutique” or “lifestyle” hotel brands which have greater financial resources and economies of scale; |

| · | Adverse effects of general and local political and/or economic conditions; |

| 10 |

| · | Dependence on demand from business and leisure travelers, which may fluctuate and be seasonal; |

| · | Increases in energy costs, airline fares and other expenses related to travel, which may deter travel; |

| · | Impact of financial difficulties of the airline industry and potential reduction in demand on hotel rooms; |

| · | Increases in operating costs attributable to inflation and other factors; |

| · | Overbuilding in the hotel industry, especially in individual markets; and |

| · | Disruption in business and leisure travel patterns relating to perceived fears of terrorism or political unrest. |

The boutique hotel market is highly competitive.

The Company competes in the boutique hotel segment, which is highly competitive, is closely linked to economic conditions and may be more susceptible to changes in economic conditions than other segments of the hospitality industry. Competition within the boutique hotel segment is also likely to continue to increase in the future. Competitive factors include name recognition, quality of service, convenience of location, quality of the property, pricing, and range and quality of dining, services and amenities offered. Additionally, success in the boutique hotel market depends, largely, on an ability to shape and stimulate consumer tastes and demands by producing and maintaining innovative, attractive, and exciting properties and services. The Company competes in this segment against many well-known companies that have established brand recognition and significantly greater financial resources. If it is unable to achieve and maintain consumer recognition for its brand and otherwise compete with well-established competitors, the Company’s business and operations will be negatively impacted. There can be no assurance that the Company will be able to compete successfully in this market or that the Company will be able to anticipate and react to changing consumer tastes and demands in a timely manner.

Currently, the Company’s hotel incurs overhead costs higher than the total gross margin.

The overhead costs for the Algodon Mansion hotel currently exceed its total gross margin. There can be no assurance that the Company will be able to increase revenues and lower the hotel’s overhead cost in the future.

The profitability of the Company’s hotels will depend on the performance of hotel management.

The profitability of the Company’s hotel and hospitality investments will depend largely upon the ability of any management company or general manager that it employs to generate revenues that exceed operating expenses. The failure of hotel management to manage the hotels effectively would adversely affect the cash flow received from hotel and hospitality operations.

Algodon Wine Estates and Land Development

The tourism industry is highly competitive and may affect the success of the Company’s projects.

The success of the tourism and real estate development projects underway at Algodon Wine Estates depends primarily on recreational and secondarily on business tourists and the extent to which the Company can attract tourists to the region and to its properties. The Company is in competition with other hotels and developers based upon brand affiliations, room rates, customer service, location, facilities, and the condition and upkeep of the lodging in general, and in relation to other lodges/hotels/investment opportunities in the local market. Algodon Wine Estates operates as a multi-functional resort and winery and serves a niche market, which may be difficult to target. Algodon Wine Estates may also be disadvantaged because of its geographical location in the greater Mendoza region. While the San Rafael area continues to increase in popularity as a tourist destination, it is currently less traveled than other regions of Mendoza, where tourism is more established.

The profitability of Algodon Wine Estates will depend on consumer demand for leisure and entertainment.

Algodon Wine Estates is dependent on demand from leisure and business travelers, which may be seasonal and fluctuate based on numerous factors. Demand may decrease with increases in energy costs, airline fares and other expenses related to travel, which may deter travel. Business and leisure travel patterns may be disrupted due to perceived fears of local unrest or terrorism both abroad and in Argentina. General and local economic conditions and their effects on travel may adversely affect Algodon Wine Estates.

| 11 |

Development of the Company’s projects will proceed in phases and is subject to unpredictability in costs and expenses.

It is contemplated that the expansion and development plans of Algodon Wine Estates will be completed in phases and each phase will present different types and degrees of risk. Algodon Wine Estates may be unable to acquire the property it needs for further expansion or be unable to raise the property to the standards anticipated for the ALGODON ® brand. This may be due to difficulties associated with obtaining required future financing, purchasing additional parcels of land, or receiving the requisite zoning approvals. Algodon Wine Estates may have problems with local laws and customs that cannot be predicted or controlled. Development costs may also increase due to inflation or other economic factors.

The ability of the Company to operate its businesses may be adversely affected by U.S. and Argentine government regulations.

Many aspects of the Company’s businesses face substantial government regulation and oversight. For example, hotel properties are subject to numerous laws, including those relating to the preparation and sale of food and beverages, including alcohol and those governing relationships with employees such as minimum wage and maximum working hours, overtime, working conditions, hiring and firing employees and work permits. Additionally, hotel properties may be subject to various laws relating to the environment and fire and safety. Compliance with these laws may be time consuming and costly and may adversely affect hotel operations.

Another example is the wine industry which is subject to extensive regulation by local and foreign governmental agencies concerning such matters as licensing, trade and pricing practices, permitted and required labeling, advertising and relations with wholesalers and retailers. New or revised regulations in Argentina, or other foreign countries, could have a material adverse effect on Algodon Wine Estates’ financial condition or operations.

Finally, because many of the Company’s properties are located in Argentina, they are subject to its laws and to the laws of various local districts that affect ownership and operational matters. Compliance with applicable rules and regulations requires significant management attention and any failure to comply could jeopardize the Company’s ability to operate or sell a particular property and could subject the Company to monetary penalties, additional costs required to achieve compliance, and potential liability to third parties. Regulations governing the Argentinian real estate industry as well as environmental laws have tended to become more restrictive over time. The Company cannot assure that new and stricter standards will not be adopted or become applicable to the Company, or that stricter interpretations of existing laws and regulations will not be implemented.

Algodon Wine Estates—Vineyard and Wine Production

Competition within the wine industry could have a material adverse effect on the profitability of wine sales.

The operation of a winery is a highly competitive business and the dollar amount and unit volume of wine sales through the ALGODON ® label could be negatively affected by a variety of competitive factors. Many other local and foreign producers of wine have significantly greater financial, technical, marketing and public relations resources and wine producing expertise than the Company, and many have more refined, developed and established brands. The wine industry is characterized by fickle demand and success in this industry relies heavily on successful branding. Thus, the ALGODON ® brand concept may not appeal to a large segment of the market, preventing the Company from successfully competing against other Argentinian and foreign brands. Wholesaler, retailer and consumer purchasing decisions are also influenced by the quality, pricing and branding of the product, as compared to competitive products. Unit volume and dollar sales could be adversely affected by pricing, purchasing, financing, operational, advertising or promotional decisions made by competitors, which could affect the supply of, or consumer demand for, product produced under the ALGODON ® brand.

| 12 |

Algodon Wine Estates is subject to import and export rules and taxes which may change.

Algodon Wine Estates primarily exports its products to the United States through Jomada Imports and to Europe through Algodon Europe Ltd., a wholly-owned subsidiary. In these countries and others in which Algodon Wine Estates intends to export, Algodon Wine Estates will be subject to excise and other taxes on wine products in varying amounts, which are subject to change. Significant increases in excise or other taxes could have a material adverse effect on Algodon Wine Estates’ financial condition or operations. Political and economic instabilities of foreign countries may also disrupt or adversely affect Algodon Wine Estates’ ability to export or make profitable sales in that country. Moreover, exporting costs are subject to macro-economic forces that affect the price of transporting goods (e.g., the cost of oil and its impact on transportation systems), and this could have an adverse impact on operations.

The Company’s business would be adversely affected by natural disasters.

Natural disasters, floods, hurricanes, fires, earthquakes, hailstorms or other environmental disasters could damage the vineyard, its inventory, or other physical assets of the Algodon Wine Estates’ resort, including the golf course. If all or a portion of the vineyard or inventory were to be lost prior to sale or distribution as a result of any adverse environmental activity, or if the golf course and facilities were damaged, Algodon Wine Estates would become significantly less attractive as a destination resort and therefore lose a substantial portion of its anticipated profits and cash flow. Such a loss would seriously harm the business and reduce overall sales and profits. Moderate, but irregular weather conditions may adversely affect the grapes, making any one season less profitable than expected. In addition to weather conditions, many other factors, such as pruning methods, plant diseases, pests, the number of vines producing grapes, and machine failure could also affect the quantity and quality of grapes. Any of these conditions could cause an increase in the price of production or a reduction in the amount of wine Algodon Wine Estates is able to produce and a resulting reduction in business sales and profits.

Loss of one or more of the Company’s key employees could adversely affect the Company’s businesses.

The production of wine depends on the services and expertise of highly skilled individuals in all facets of the growth and production process. Although arrangements have been made with additional winemaking talent to assist in the process, the loss of service of any of Algodon Wine Estates’ significant employees (Anthony Foster, Master of Wine; Mauro Nosenzo, winemaker; and Marcelo Pelleriti, Senior Wine Advisor of AWE) could have a material adverse effect on the Company. Further, as the manager of the property, the profitability of Algodon Wine Estates will depend largely upon Algodon Wine Estates to generate revenues that exceed operating expenses. Any failure to manage the vineyard, winery and resort effectively, or up to the caliber of the ALGODON ® brand, would adversely affect Algodon Wine Estates’ cash flow received from operations and consequently the Company’s investment. Problems with local labor could also have a material adverse effect on Algodon Wine Estates.

Risks Associated with DPEC Capital’s Business

DPEC, as a broker-dealer, is subject to extensive regulation.

The securities industry in the United States is subject to extensive regulation under both federal and state laws. Broker-dealers are subject to regulations covering all aspects of the securities business, including: (1) sales methods; (2) trade practices among broker-dealers; (3) use and safekeeping of customers’ funds and securities; (4) capital structure; (5) record keeping; (6) conduct of directors, officers, and employees; and (7) supervision of employees, particularly those in branch offices. The principal purpose of regulation and discipline of broker-dealers is the protection of customers and the securities markets, rather than protection of creditors and stockholders of broker-dealers.

Uncertainty regarding the application of these laws and other regulations to DPEC Capital’s business may adversely affect the viability and profitability of the business. The SEC, FINRA, other self-regulatory organizations and state securities commissions can censure, fine, issue cease-and-desist orders, or suspend or expel a broker-dealer or any of its officers or employees. DPEC Capital’s ability to comply with all applicable laws and rules is largely dependent on its establishment and maintenance of a compliance system to ensure such compliance, as well as its ability to attract and retain qualified compliance personnel. DPEC Capital could be subject to disciplinary or other actions due to claimed noncompliance in the future, and the imposition of any material penalties or orders could have a material adverse effect on the business, operating results and financial condition. In addition, it is possible that noncompliance could subject DPEC Capital to future civil lawsuits, the outcome of which could harm the business.

In addition, the mode of operation and profitability may be directly affected by: (1) additional legislation; (2) changes in rules promulgated by the SEC, state regulators, FINRA, and other regulatory and self-regulatory organizations; and (3) changes in the interpretation or enforcement of existing laws and rules.

| 13 |

DPEC Capital and certain of its principals have a significant number of disclosure events publicly reported at www.finra.org.

As a broker-dealer registered with the SEC and a member of FINRA, DPEC Capital must make its compliance with the rules of the SEC and FINRA and various state agencies publicly available. These reports are available for DPEC Capital at Broker Check, available at www.finra.org .. The report for DPEC Capital includes eight disclosure items, including four regulatory sanctions and four awards or judgments. In addition, several registered representatives of DPEC Capital, including principals Scott L. Mathis and Keith T. Fasano also have personal disclosure events reported to FINRA. See Item 8—Legal Proceedings for more information.

| 14 |

The Chairman and CEO of AWLD is currently subject to a regulatory matter which could result in him becoming statutorily disqualified from participating in the securities industry.

Scott Mathis, Chairman of the Board of Directors of AWLD and Chief Executive Officer of AWLD, is a registered representative associated with DPEC Capital. The publicly-available FINRA disclosure report for Mr. Mathis reflects a number of disclosure events, including one ongoing regulatory matter (discussed in the following paragraph). A description of certain of the matters underlying these disclosures is set forth below. See Item 8 - Legal Proceedings.

In 2007, Scott Mathis was found by FINRA to have willfully failed to make, or timely make, certain disclosures on his Form U-4 in connection with certain tax liens. Mr. Mathis has consistently disputed the willfulness finding, and has challenged that finding on appeal to the SEC and the U.S. Court of Appeals. However, both of those appeals were unsuccessful. Under applicable FINRA rules, the finding that Mr. Mathis acted willfully subjects him to a “statutory disqualification,” which could prevent him from working in the securities industry. In accordance with FINRA rules, Mr. Mathis filed Form MC-400 with FINRA in September 2012, requesting that he be permitted to continue to work in the securities industry notwithstanding the fact that he is subject to a statutory disqualification. The matter is still pending and a hearing has been rescheduled for October 16, 2014 and a decision anticipated in the fourth quarter of 2014.

Were Mr. Mathis statutorily disqualified from participating in the securities industry, Mr. Mathis would be required to resign all positions that he has with DPEC Capital, Inc. He will cease being a registered representative and principal of the firm, he will resign as an officer and director of DPEC Capital, Inc., and he will not in any way be involved in the business or operations of the firm. While Mr. Mathis’s duties and responsibilities with DPEC Capital could be transferred to other current (and possibly future) employees, the ability of DPEC Capital to raise investment capital for the Company may be diminished, and in turn could have an adverse effect on the Company’s ability to conduct operations or expand and develop its business.

Further, in the event the continued ownership of DPEC Capital by the Company adversely affected the Company’s other business segments or operations, or Mr. Mathis’s role at the Company would otherwise interfere with DPEC Capital’s ability to function as a registered broker-dealer, the Company would likely seek to divest DPEC Capital, for example, through a spin-off or sale. Management has not yet determined whether it could sell or spin off DPEC Capital, and if it could, whether it could do so on acceptable terms. The Company currently has no plan to divest DPEC Capital. See Item 8—Legal Proceedings for more information.

Potential misconduct by DPEC employees would have a material adverse effect on its business.

There have been a number of highly publicized cases involving fraud or other misconduct by employees in the financial services industry in recent years, and DPEC Capital runs the risk that employee misconduct could occur. Misconduct by employees could include binding DPEC Capital to transactions that exceed authorized limits or present unacceptable risks, or hiding unauthorized or unsuccessful activities. In either case, this type of conduct could result in unknown and unmanaged risks or losses. Employee misconduct could also involve the improper use of confidential information, which could result in regulatory sanctions and serious reputational harm. It is not always possible to deter employee misconduct, and the precautions DPEC Capital takes to prevent and detect this activity may not be effective in all cases.

DPEC Capital is subject to the SEC’s Net Capital Rule which at times it may not be able to meet.

The SEC, FINRA and various other regulatory agencies have stringent rules with respect to the maintenance of specific levels of net capital by securities brokers, including the SEC’s Uniform Net Capital Rule. Failure to maintain the required net capital may subject a firm to suspension or revocation of registration by the SEC and suspension or expulsion by FINRA and other regulatory bodies and ultimately could require the firm’s liquidation. A significant operating loss or any unusually large charge against net capital could adversely affect the ability of DPEC Capital to operate and/or expand, which could have a material adverse effect on its business, financial condition and operating results.

At least ten years ago, DPEC Capital had a negative net capital, which is a violation of SEC rules. Upon realization of this situation, DPEC Capital took action to immediately re-establish full compliance with net capital requirements. Thus, while DPEC Capital believes that it is presently in compliance with net capital requirements, there can be no assurance that it will not fall below minimum net capital requirements in the future.

| 15 |

DPEC is subject to risks in meeting customer margin requirements.

The brokerage business is subject to risks related to defaults by customers in paying for securities they have agreed to purchase or failure to deliver securities they have agreed to sell. DPEC Capital’s clearing firm may make margin loans to its customers in connection with their purchase of securities. DPEC Capital is required by contract to indemnify its clearing firm for, among other things, any loss or expense incurred due to defaults by its customers in failing to repay margin loans or maintain adequate collateral for those loans. DPEC Capital is therefore subject to risks inherent in extending credit, especially during periods of rapidly declining markets or in connection with the purchase of highly volatile stocks which could lead to a higher risk of customer defaults. Such defaults could lead to significant liabilities for DPEC Capital.

Major declines in the public markets may adversely affect DPEC’s profitability.

Future revenues are likely to be lower during periods of declining securities prices or securities market inactivity in the sectors in which DPEC Capital focuses. The public markets have historically experienced significant volatility not only in the number and size of share offerings, but also in the secondary market trading volume and prices of newly issued securities. Activity in the private equity markets frequently reflects prevailing trends in the public markets. As a result, revenues from brokerage activities may also be adversely affected during periods of declining prices or inactivity in the public markets.

For example, investments that are traded on exchanges or over-the-counter and the risks associated therewith will vary in response to a wide array of events that affect such markets and that are beyond the control of DPEC Capital. Market disruptions such as those that occurred during October 1987, September 2001, and 2008-09, could result in substantial losses to DPEC Capital.

From time to time, DPEC may be subject to certain legal proceedings.

There is a risk of litigation inherent in conducting a securities brokerage business, both from the investor/customer side and from the company/issuer side. These risks include potential liability for violations under federal and state securities and other laws for allegedly false or misleading statements made in connection with securities offerings or other financial transactions. DPEC Capital also faces the possibility that customers or counterparties will claim that it improperly failed to apprised them of applicable risks or that they were not authorized or permitted under applicable corporate or regulatory requirements to enter into transactions with DPEC Capital and that their obligations to DPEC Capital are not enforceable.

These risks are often difficult to assess or quantify and their existence and magnitude often remain unknown for substantial periods of time. DPEC Capital may incur significant legal expenses in defending against litigation or in a regulatory proceeding. Substantial legal liability or the imposition of regulatory sanctions against DPEC Capital could have a material adverse effect on DPEC Capital.

General Corporate Business Considerations

Insiders continue to have substantial control over the Company.

As of April 30, 2014, the Company’s directors and executive officers hold the current right to vote approximately 14.97% of the Company’s outstanding voting stock (common and preferred as-converted). Of this total, 93.46% is owned or controlled, directly or indirectly by Company CEO Scott Mathis. In addition, the Company’s directors and executive officers have the right to acquire additional shares which could increase their voting percentage significantly. As a result, Mr. Mathis acting alone, and/or many of these individuals acting together, may have the ability to exert significant control over the Company’s decisions and control the management and affairs of the Company, and also to determine the outcome of matters submitted to stockholders for approval, including the election and removal of a director, the removal of any officer and any merger, consolidation or sale of all or substantially all of the Company’s assets. Accordingly, this concentration of ownership may harm a future market price of the Shares by:

| · | Delaying, deferring or preventing a change in control of the Company; |

| 16 |

| · | Impeding a merger, consolidation, takeover or other business combination involving the Company; or |

| · | Discouraging a potential acquirer from making a tender offer or otherwise attempting to obtain control of the Company. |

The Company may not be able to continue as a going concern.

Our independent auditors noted that our recurring losses from operations ($4,390,055, $8,007,586 and $7,167,357 for the six months ended June 30, 2014 and the years ended December 31, 2013 and 2012, respectively) and negative net operating cash flow ($3,231,260, $4,543,728 and $6,209,019 for the six months ended June 30, 2014, and the years ended December 31, 2013 and 2012, respectively) raise substantial doubt about our ability to continue as a going concern. This may hinder our future ability to obtain financing, or may force us to obtain financing on less favorable terms than would otherwise be available.

Revenues are currently insufficient to pay operating expenses and costs which may result in the inability to execute the Company’s business concept.

The Company’s operations have to date generated significant operating losses, as reflected in the financial information included in this Registration Statement. Management’s expectations in the past regarding when operations would become profitable have been not been realized, and this has continued to put a strain on working capital. Business and prospects must be considered in light of the risks, expenses, and difficulties frequently encountered by companies in the early stages of operations. If the Company is not successful in addressing these risks, its business and financial condition will be adversely affected. In light of the uncertain nature of the markets in which the Company operates, it is impossible to predict future results of operations.

The Chief Executive Officer and the Chief Financial Officer of AWLD are also involved in outside businesses which may affect their ability to fully devote their time to the Company.

Scott Mathis, Chairman of the Board of Directors of AWLD, Chief Executive Officer, President and Treasurer of AWLD is also the Chairman and Chief Executive Officer of Hollywood Burger Holdings, Inc., a private company he founded which is developing Hollywood-themed American fast food restaurants in Argentina and the United Arab Emirates. His duties as CEO of Hollywood Burger Holdings, Inc. consume approximately 15-25% of his time, which may interfere with Mr. Mathis’ duties as the CEO of AWLD. In addition, Tim Holderbaum, Executive Vice President, Chief Financial Officer and Secretary of AWLD is also the Chief Financial Officer of Hollywood Burger Holdings, Inc. His duties as CFO of Hollywood Burger Holdings, Inc. consume approximately 10% of his time, which may interfere with Mr. Holderbaum’s duties as the CFO of AWLD. Mark Downey, who will replace Mr. Holderbaum as CFO and Chief Operating Officer of AWLD, will also serve as CFO of Hollywood Burger Holdings Inc. and devote approximately the same amount of time, possibly interfering with his duties as CFO and COO of AWLD.

Our management is relatively inexperienced with running a public company and could create a risk of non-compliance.

Although some of AWLD’s officers and directors are also officers and directors of Mercari Communications Group, Ltd., a publicly reporting company, management’s inexperience may cause us to fall out of compliance with applicable regulatory requirements, which could lead to enforcement action against us and a negative impact on our stock price.

Compliance with changing regulation of corporate governance and public disclosure may result in additional expenses and could create a risk of non-compliance.

Changing laws, regulations and standards relating to corporate governance and public disclosure have created uncertainty for public companies and significantly increased the costs and risks associated with accessing the public markets and public reporting. These corporate governance standards are the product of many sources, including, without limitation, public market perception, stock exchange regulations and SEC disclosure requirements. Our management team expects to invest significant management time and financial resources to comply with both existing and evolving standards for public companies, which will lead to increased general and administrative expenses and a diversion of management time and attention from revenue generating activities to compliance activities. Management’s inexperience may cause us to fall out of compliance with applicable regulatory requirements, which could lead to enforcement action against us and a negative impact on our stock price.

| 17 |

We may incur losses and liabilities in the course of business which could prove costly to defend or resolve.

Companies that operate in one or more of the businesses that we operate face significant legal risks. There is a risk that we could become involved in litigation wherein an adverse result could have a material adverse effect on our business and our financial condition. There is a risk of litigation generally in conducting a commercial business. These risks often may be difficult to assess or quantify and their existence and magnitude often remain unknown for substantial periods of time. We may incur significant legal expenses in defending against litigation.

The Company will face significant regulation by the SEC and state securities administrators.

The holders of shares of AWLD’s common stock and preferred stock may not offer or sell the shares in private transactions or (should a public market develop, of which there can be no assurance) public transactions without compliance with regulations imposed by the SEC and various state securities administrators. To the extent that any holder desires to offer or sell any such shares, the holder must prove to the reasonable satisfaction of AWLD that he has complied with all applicable securities regulations, and AWLD may require an opinion of the holder’s legal counsel to that effect. Thus, there can be no assurance that the holder will be able to resell the shares or any interest therein when the holder desires to do so.

The Company is dependent upon additional financing which it may not be able to secure in the future.

As it has in the past, the Company will likely continue to require financing to address its working capital needs, continue its development efforts, support business operations, fund possible continuing operating losses, and respond to unanticipated capital requirements. For example, the continuing development of the Algodon Wine Estates project requires significant ongoing capital expenditures. There can be no assurance that additional financing or capital will be available and, if available, upon acceptable terms and conditions. To the extent that any required additional financing is not available on acceptable terms, the Company’s ability to continue in business may be jeopardized.

Additionally, if the Company’s debt holders do not agree to convert their notes into equity or extend the maturity dates of their notes, the Company may need to curtail its operations and implement a plan to extend payables and reduce overhead until sufficient additional capital is raised to support further operations. There can be no assurance that such a plan will be successful. Such a plan could have a material adverse effect on the Company’s business, financial condition and results of operations, and ultimately the Company could be forced to discontinue its operations, liquidate and/or seek reorganization in bankruptcy.

The Company’s officers and directors are exculpated and indemnified against certain conduct that may prove costly to defend.

The Company may have to spend significant resources indemnifying its officers and directors or paying for damages caused by their conduct. The Company’s Amended and Restated Certificate of Incorporation exculpates the Board of Directors and its affiliates from liability, and the Company has procured directors’ and officers’ liability insurance to reduce the potential exposure to the Company in the event damages result from certain types of potential misconduct. Furthermore, the General Corporation Law of Delaware provides for broad indemnification by corporations of their officers and directors, and the Company’s bylaws implement this indemnification to the fullest extent permitted under applicable law as it currently exists or as it may be amended in the future. Consequently, subject to the applicable provisions of the General Corporation Law of Delaware and to certain limited exceptions in the Company’s Amended and Restated Certificate of Incorporation, the Company’s officers and directors will not be liable to the Company or to its stockholders for monetary damages resulting from their conduct as an officer or director.

The Company has not paid dividends to date.

Neither AWLD nor any of its constituent companies has ever paid any dividends or made any distributions to their stockholders or members. The Company plans to pay dividends to the Series A convertible preferred stockholders as of the effective date of this Registration Statement as set forth in the Company’s Amended and Restated Certificate of Designation. The Company does not contemplate or anticipate declaring or paying any dividends on its common stock in the foreseeable future. It is anticipated that earnings, if any, will be used to finance the development and expansion of the Company’s business.

| 18 |

Former stakeholders of certain of AWLD’s subsidiaries holding assets in Argentina may challenge the transactions acquiring AGP and IPG.

On September 30, 2010, AWLD and IPG entered into an Exchange Agreement, whereby all members of IPG, including The WOW Group, LLC exchanged their membership units for shares of AWLD common stock (the “IPG Exchange Transaction”). Consequently all former IPG members became stockholders of AWLD and AWLD became the sole member of IPG.

When it was acquired by AWLD in 2010, IPG had substantial ownership interests in, and developed and managed, two primary projects in Argentina: (1) the Algodon Mansion, a luxury boutique hotel located in the Recoleta district of Buenos Aires; and (2) the Algodon Wine Estates, located in San Rafael, in the Mendoza region of Argentina. The ownership interests in these projects not owned by IPG were subsequently acquired by AWLD in June 2012 when AWLD and Algodon Global Properties, LLC (“AGP”) entered into an Exchange Agreement, and all members of AGP exchanged their membership units for shares of AWLD common stock (the “AGP Exchange Transaction”). Consequently all former AGP members became stockholders of AWLD and AWLD became the sole member of AGP. As a result of that transaction, AWLD now owns 100% of the Argentina projects which IPG has been developing since 2007.

The IPG Exchange Transaction and the AGP Exchange Transaction were approved by a majority vote of the combining stakeholders, however it is possible that AWLD stockholders or former members of the combined entities could challenge these transactions. To date, AWLD has not received any such notice.

ITEM 1. BUSINESS.

Business and Overview of AWLD

Through its wholly-owned subsidiaries, AWLD invests in, develops and operates real estate projects in Argentina. AWLD operates a hotel, golf and tennis resort, vineyard and producing winery in addition to developing residential lots located near the resort. The activities in Argentina are conducted through its operating entities: InvestProperty Group, LLC, Algodon Global Properties, LLC, The Algodon – Recoleta S.R.L, Algodon Properties II S.R.L., and Algodon Wine Estates S.R.L. AWLD distributes its wines in Europe through its United Kingdom entity, Algodon Europe, LTD.

Another wholly-owned subsidiary, DPEC Capital, Inc. is a traditional retail securities brokerage firm which offers various non-public investment opportunities in AWLD projects and Hollywood Burger Holdings, Inc. (a private company founded by Scott Mathis which is developing Hollywood-themed American fast food restaurants in Argentina and the United Arab Emirates) to qualified investors. DPEC Capital, Inc. is a registered broker-dealer and member of FINRA (Financial Industry Regulatory Authority), SIPC (Securities Investor Protection Corporation), and SIFMA (Securities Industry and Financial Markets Association). Since approximately 2004, DPEC Capital has concentrated its efforts on raising money for investment vehicles that were formed by its corporate affiliates, many of which were in the biotech sector, for corporate affiliates that were raising capital to invest in the various projects being developed in Argentina, or for other operating businesses under common control with AWLD.

In the U.S., AWLD currently employs approximately 12 full time employees, including seven who are registered representatives of DPEC Capital, Inc. and are compensated in part on a commission basis. None of these employees is covered by a collective bargaining agreement and management believes it has good relations with its employees. Including the operating subsidiaries in Argentina, the Company has approximately 110 full-time and 15 part-time employees.

AWLD also holds as one of its assets, a shell corporation that is current in its reporting obligations under the Securities Exchange Act of 1934 and a ready target for merger or sale.

| 19 |

The below table provides an overview of AWLD’s operating entities.

| Entity Name | Abbreviation | Jurisdiction

& Date of Formation |

Ownership | Business | ||||

InvestProperty Group, LLC (“InvestProperty Group”) |

IPG | Delaware, October 27, 2005 |